The sales and operation planning (S&OP) process has been around for a long time. For those that have successfully put S&OP into practice, there have been measurable benefits. However, many organizations struggle with putting the plan into action. In fact, there is surging interest in the idea of S&OE with the “E” representing execution instead of “planning”. The underlying challenge of this segment is that they are done with “planning” for S&OP, they must get a workable, repeatable process completed.

Others are moving beyond S&OP and into integrated business planning (IBP). Let’s take a moment to consider the differences between S&OP and IBP. After all, S&OP and IBP have similar foundations and the lines between the processes can be blurred.

Scope

S&OP is primarily focused on the sales and operations functions of the organization, while IBP encompasses the entire enterprise. IBP aims to align all aspects of the business, including finance, marketing, human resources and supply chain.

Timeframe

S&OP typically has a shorter time horizon, typically 12-24 months, while IBP usually operates on a longer time horizon, spanning three to five years.

Frequency

S&OP is usually a monthly process, while IBP is often done quarterly or annually.

Decision-making

S&OP is typically used to make tactical decisions about demand and supply planning, while IBP makes more strategic decisions about resource allocation, risk management, and business performance.

Information and Analytics

IBP involves more comprehensive data gathering and analysis, including financial and operational metrics, scenario planning, and risk management. S&OP typically focuses more on demand and supply data.

Using information from across all business units allows for the identification of gaps in process/revenue objectives, options to address these gaps and ultimately a plan to close them. This is done by running simulations and asking “what-if” scenarios to determine risks and outcomes.

Stakeholder Engagement

IBP typically involves a wider range of stakeholders, including executives, functional leaders, and external partners. S&OP is more focused on the sales and operations teams. Additionally, the ownership of the IBP process tends to be in the “corner office”. For S&OP, the ownership is usually at the manager/functional owner level.

IBP is not for everyone. The level of organizational engagement and commitment is high and there may not be a pay-off in terms of the level of effort vs. benefit. If the items below are true for your business, an IBP plan may be right for you.

Multiple Business Units

For organizations with multiple business units and different products, services, and markets, IBP can help ensure that resources are allocated effectively across the enterprise. It also ensures alignment with the overall business strategy.

Complex Supply Chain

When an organization has complex supply chains and multiple suppliers, manufacturing facilities, and distribution channels, IBP can ensure that supply and demand are balanced, risks are managed, and resources are optimized.

Global Operations

IBP can help ensure that local market conditions and regulations are factored into the planning process and that resources are allocated effectively across the global enterprise.

Long-term Planning

IBP can help ensure that the supply chain strategy is aligned with the overall business objectives and that the resources are allocated effectively to achieve those objectives over a longer time horizon.

Comprehensive Analytics

IBP can help provide a more holistic view of the business, including financial and operational metrics, scenario planning, and risk management that feed into strategic decisions.

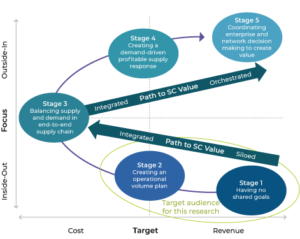

Understanding the appropriate approach to planning for your business is a good starting point. Before moving into action, it makes sense to understand your readiness to undertake S&OP/IBP. A few years back, Gartner benchmarked an S&OP maturity scale. The steps in this progression begin with no plan to enterprise-wide coordination.

Click to enlarge

Moving up in scale comes down to the typical levers of people, processes and technology. Stages 1 and 2 are more dependent on people and processes. The movement to stage 3 and beyond requires some technological assistance. Especially for larger and more complex supply chains.

Regardless of where you are on this maturity scale, ask yourself these questions:

- Who stands to benefit from implementing/improving your planning process? These are the individuals who need to be engaged/brought into the initiative. As a supply chain leader, your focus may be heavily operational (as in moving inventory from A to B), but do the finance or product teams benefit? The answer is probably yes. Do not overlook them as they can be advocates for change.

- Where is your organization going to be in 5 years? How important are sustainability or streamlined operations? Align your plans with the corporate vision (which is a large IBP stepping stone).

- Conduct an internal gap assessment on your process and technology capabilities. Focus on where your current process breaks down and its impact on the business. Look at ways to close the gap/plug leaks. This journey is evolutionary. Do not bite off more than you can chew. Work these improvements in manageable and measurable steps. Going from stage 2 to stage 4 in a year will not be workable for most organizations.

- Perhaps the trickiest change is understanding the person who owns this initiative. It’s OK to have multiple people involved in the process, but there must be one person singularly responsible for the planning and outcome of S&OP/IBP. Multiple owners will bog this initiative down and muddy the results.

Given the level of effort involved in this, the final question is, is S&OP or IBP worth it? Here is a sampling of 40 clients from Colleen Crum at Oliver Wight, a leading consulting firm in integrated business planning on the range of improvements for those that embarked on an IBP journey:

- Increased demand plan accuracy by 18-25%

- Increased sales revenue by 10-15%

- Increased on-time delivery by 10-50%

- Inventory reduction by 18-46%

- Safety stock reduction by 11-45%

- Increased productivity by 30-45%

What if a company can improve its performance by the above amounts? What would be the impact on financial performance and/or customer satisfaction?

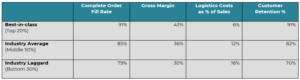

A study by Aberdeen Research sheds some light on the answers to previous questions. The following show results documented by companies using IBP, categorized by best-in-class, industry average and industry laggards.

Click to enlarge

As you can see, the business case is there. All it takes is the vision and drive to get moving. If you are not moving forward, you risk going backward. If you need a little push to get going, contact Arkieva. Our team would be happy to discuss your current state and objectives and add to the business case you need to make.