Click here if you missed Part 1

Deriving a strategic benchmark for Product Leadership, Operational Excellence and Customer Intimacy in the Supply Chain Triangle.

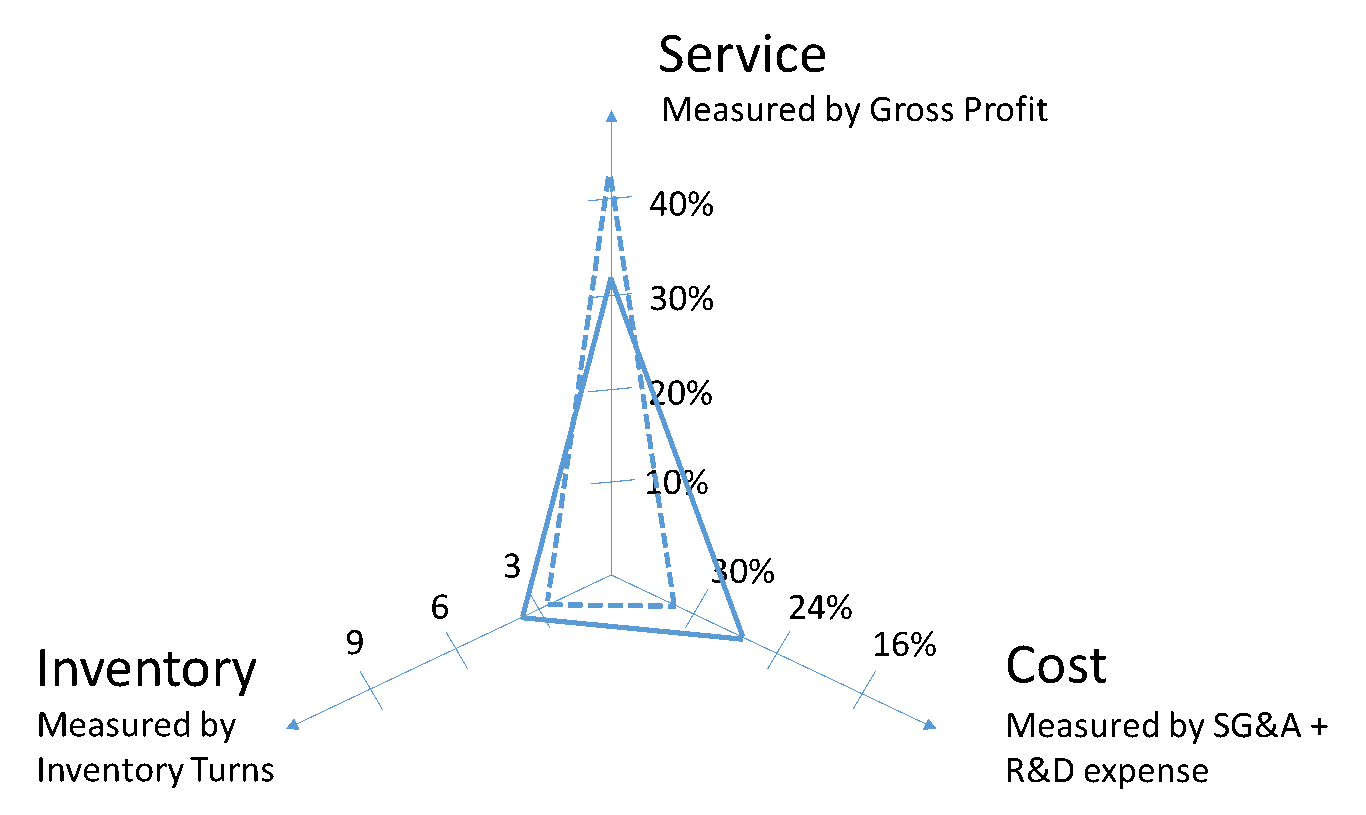

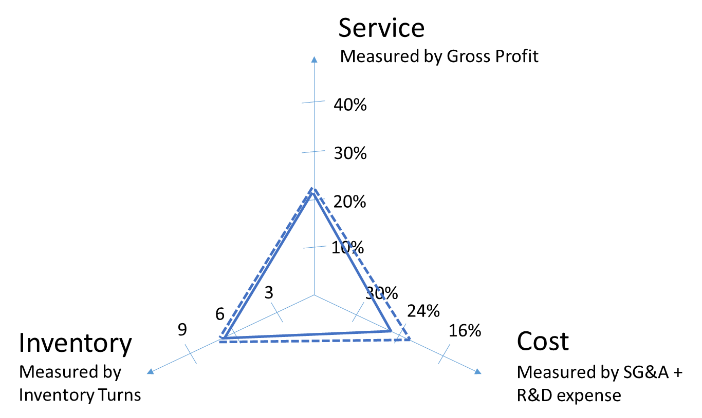

From the benchmark data gathered in the previous sections and the previous blogs, we can distill the benchmark for Product Leadership, Operational Excellence and Customer Intimacy, shown in Figure 9. The benchmark is specific for the segment of the high-tech sector we have been studying. However, the approach can be used for other sectors as well.

As a general approach, we will use the gross margin as a financial measure for the service dimension. As discussed above, we expect a product leader can drive superior gross margin through superior service and emotion. A higher gross margin allows for higher Sales and Marketing and R&D costs. These are the costs we will show on the ‘cost dimension’. On the inventory axis we will show inventory turns.

Figure 9 – Benchmarking product leaders, opex leaders and customer intimacy players in the Supply Chain Triangle

We start with defining the benchmark for a product leader. From Figure 5 we see a premium gross profit for Company 1 in the period 2004-2007. Gross profit around 40%, with combined SG&A and R&D spending around 30%, leading to an EBIT of around 10%. The 10% EBIT corresponding with an average inventory turn of 3, as shown in Figure 8.

From that same Figure 5 we see that company 4 is moving in the direction of the 40% gross margin. As it has been moving in the direction of the 40% gross margin, it has been increasing SG&A and R&D spending in the 30% direction. From Figure 8 we see the inventory has been moving in the direction of 3 turns. That confirms the chosen position of the product leader in Figure 9.

From Figure 5 we also see the gross profit of Company 1 has come down to around 32%. In general we see some consistency around the 30-32% for Company 1 (post-crisis), for Company 2, for Company 3 and for Company 4 pre-crisis. Company 6 has a lower level of gross profit. Company 5 goes in the direction of 20% gross profit. 20% gross profit means razor thin margins, leaving little room for SG&A and R&D spending. We take that as the gross profit position for the Opex Leader. We’ll take the 30% gross profit as the position for the customer intimacy leader.

When defining target levels for the turns, we turn back to Figure 8. Company 1 and 2 are around turns of 3. Company 4 starts around 6 and is coming down, cfr. our comment above, it is moving in the product leadership direction. Company 5 and 6 range between 6 and 8 turns. Company 2 even goes to 9 and 10 turns. Given 9 turns is possible in the industry, it is proven by Company 2, we will take that as the target for the Opex Leader. We will position the turns of 6 as the target level for a customer intimacy player.

If we have fixed the ‘gross profit’ and the ‘inventory turns’ position, we can calculate the corresponding ‘cost’ position starting from the assumption that each of the strategies should give a comparable EBIT per inventory $. We will not show the math here but the result is that the EBIT% for a Customer Intimacy player should be 5.83%, for an Opex player it should be 4.44%.

If the target EBIT% for the customer intimacy leader is 5.83%, let’s say 6%, for a gross margin of 30%, this means he can spend 24% on SG&A and R&D. If the target EBIT% for the Opex leader is 4.44%, let’s say 4%, for a gross margin of 20%, this means he can spend 16% on SG&A and R&D. Hence the 24% and the 16% as rounded figures on the cost axis of Figure 9.

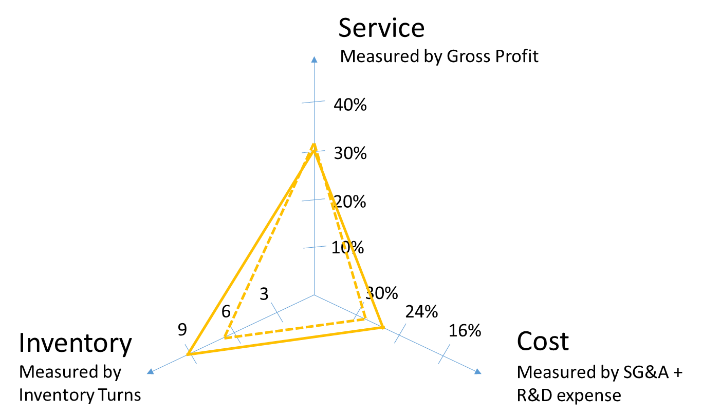

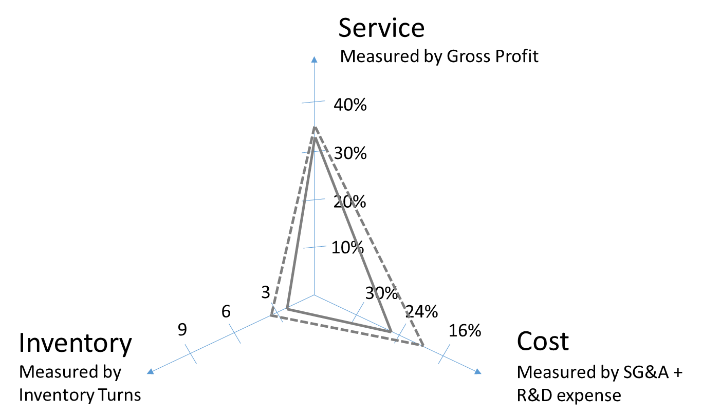

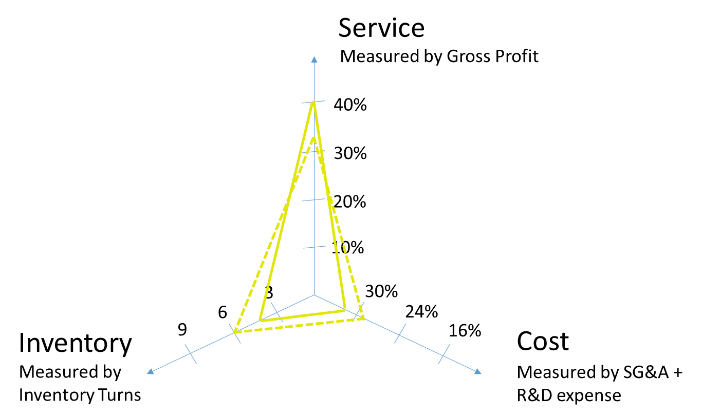

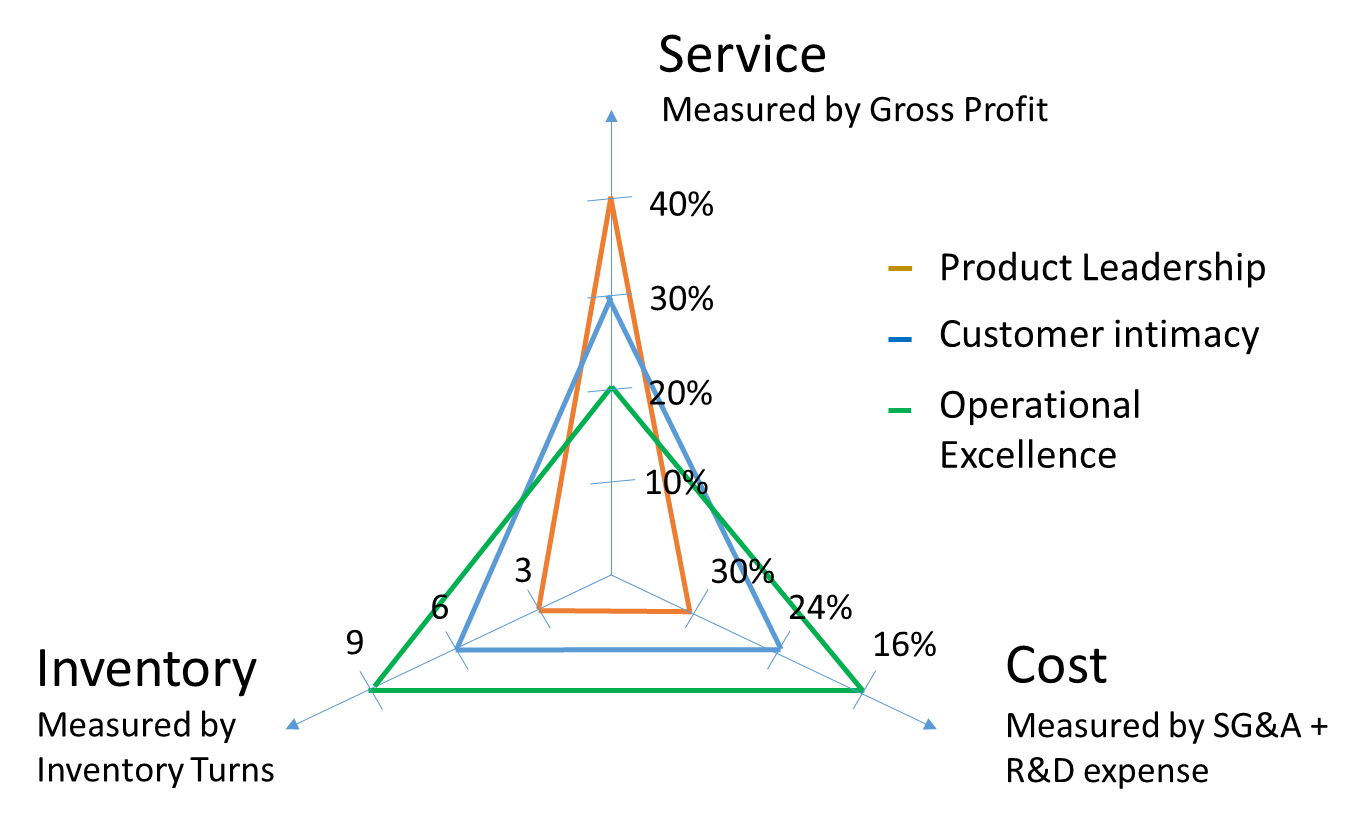

Using the Strategic Benchmark to Compare the Strategic Positioning of our 6 Benchmark Companies.

For each of the companies 1 to 6 we can now plot their position ‘at the beginning of the 10 year period’ and ‘at the end of the 10 year period’. To smooth the effects of individual years, we have taken the average of the first 3 years and the average of the last 3 years.

Figure 10 – Benchmarking companies 1 to 6 on the Supply Chain Triangle using competitive benchmarks for a Product Leader, a Customer Intimacy and an Opex Leader

The following can be learned from Figure 10 for each of the 6 companies:

- Company 1: compared to its original position as a product leader, it is overspending (especially on R&D) and carries to much inventory to reflect its new gross profit situation

- Company 2: is overspending on SG&A and R&D, seems too aggressive in its inventory turns, keeping some more inventory can probably help it to get costs down

- Company 3: was under-spending in the first three years, is slightly overspending today, inventories are not in line with its gross profit position

- Company 4: is gaining ground as a product leader, gross margins have improved, they are slightly overspending, inventories have increased in line with the expectations of a product leader

- Company 5: gross profit is too low for the current spending and inventory levels, to gain a decent EBIT per inventory $ both should be reduced

- Company 6: the original position was quite balanced, the position over the last 3 years shows signs of overspending or below standard EBIT per inventory $

This competitive benchmark now allows connecting inventory targets to targets for gross profit and for SG&A and R&D spending. It also allows connecting the targets to the competitive strategy.

If we continue taking Company 1 as an example, we could say that either it tries to regain its position as a product leader. To do so it might need to divest some of the lower margin business and push innovation to drive gross margin. Or either the company leaves the position as a product leader and plays in the middle ground. To be competitive there, it will need to reduce costs, especially in R&D, and reduce inventories. To reduce inventories, it will need to shed some complexity of its past as a product leader. This might include divesting some of the innovation intensive and more complex businesses.

Treacy & Wiersema advocate we need to make explicit choices and stay true to them. If not, we will send mixed signals and may get caught in the middle. The strategic benchmarking helps in making the choices clear.

In conclusion, we can use public financial data to do strategic benchmarking. Deriving the strategic benchmark requires the analysis of a larger set of companies. Once the strategic benchmark has been derived, it clarifies the choices for each of the benchmark companies. It touches on the inventory, but goes much further to include targets for gross profit, R&D and SG&A spending. This concludes our series of ‘Inventory Benchmarking’ blogs.