Allow me to start this blog with a personal story. In November 2021, I plunked down $100 to put my name on a list to obtain a Volkswagen (VW) ID.4. The ID.4 is VW’s new, all-electric vehicle and is one of their most popular offerings. In the US, the backlog is over 25,000 vehicles and VW can only ship about 2.000 per month from Europe. So, from the get-go there is a mathematical challenge to meet demand. Add a sunk container ship with already-sold ID.4’s submerged forever and wiring assemblies coming from the Ukraine, and you have a perfect storm of unmitigated risk. Oh, one more thing – to meet demand, VW is converting a factory in the US to build ID.4’s in Tennessee and is sourcing a new battery supplier. This factory will not be online until the summer of 2022 at the earliest. By the time the factory is operational, the backlog may be close to 40,000 vehicles. As a consumer, I am likely not going to see my vehicle until 2023. Can you imagine the amount of antacid VW’s supply chain team is ingesting to deal with these challenges?

And this situation is not unique to VW, countless businesses around the globe are rolling out new products, building out infrastructure, and fighting for market share. In these disruptive times, there is immense pressure for supply chain leaders to deliver the goods despite strong supply-side headwinds and fickle customers.

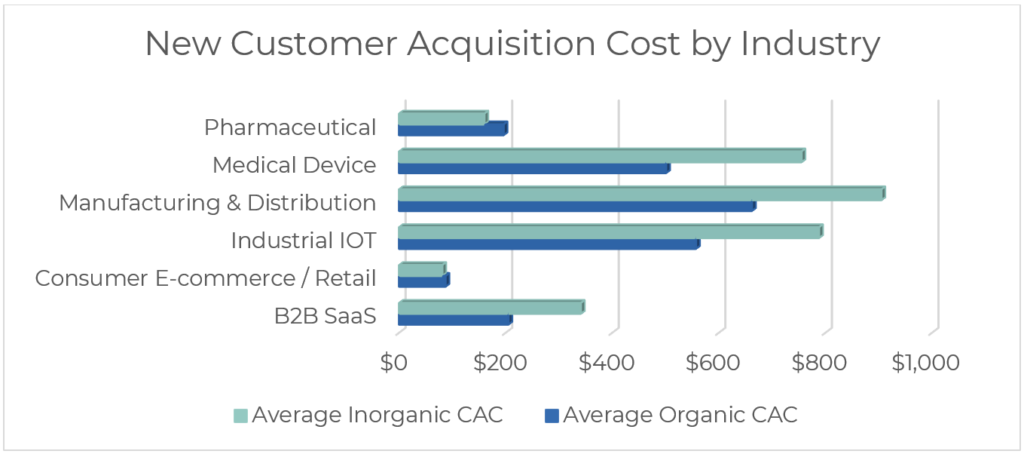

What’s the Cost to Acquire a Customer?

For manufacturers, it can cost up to $900 to add one new logo. For retail/CPG the cost is less, but you need a lot more people to buy a pair of jeans to be profitable.

A lost customer represents not just the loss of future revenue, but also the cost to replace that customer by a factor of 2 if you drive growth. So, losing customers may actually cost thousands of dollars. Going back to the VW example, underestimating demand, and not having vehicles ready for sale, will cause defection to other brands. In the auto industry it may be years before another opportunity exists to replace the vehicle purchased. Cars are kept for years, and people tend to stay with the brands they have. Thus, the competitive advantage VW had by offering an affordable all electric car will now be nullified over the next few years as new models flood the market.

S&OP is a Necessity

Regardless, if the product is a consumable such as a 4-pack of yogurt or a durable product such as a washing machine or Trek Siding, the folks making the product and the folks selling the product need to be marching in lockstep with one another – and they need to be aligned with senior leaderships’ vision for the direction of the company. That’s why S&OP is so important. Without it, teams lose the synchronization and focus required to run efficiently. They tend to spin-off into their own worlds with sales teams doing whatever it takes to sell more products. Senior leadership is tasked with keeping shareholders, bankers, and lawyers happy. And the supply chain team is trying, figuratively, to keep the ship from sinking. (It’s always the supply chain team that has to be the hero). This creates a lot of finger pointing when things go awry.

Back to My Personal Story

Would an S&OP process have prevented the delay producing the required number of ID.4’s to meet customer orders? Afterall, the Russia and Ukraine conflict was not seen as likely and who knew a containership would sink. However, aligning production capacity with demand is important. This is true for large manufacturers and true for promotion planning of consumables such as yogurt. Selling “vapor” will only last so long before the customer gets wise to the reality. True too is matching marketing spend to internal infrastructure. Should VW be aggressively promoting the ID.4 in the US while a factory is being retooled and suppliers set up? Balancing the opportunity window for sales against the ability to deliver was (and is) an absolute necessity.

So yes, S&OP makes total sense for this example. And it may very well be that VW has a process in place to align sales with marketing and the supply chain. In this case it broke down. The net result? I just ordered a Hybrid Toyota Camry and will hope to see my deposit returned from VW.

To learn more about S&OP management, visit our website.