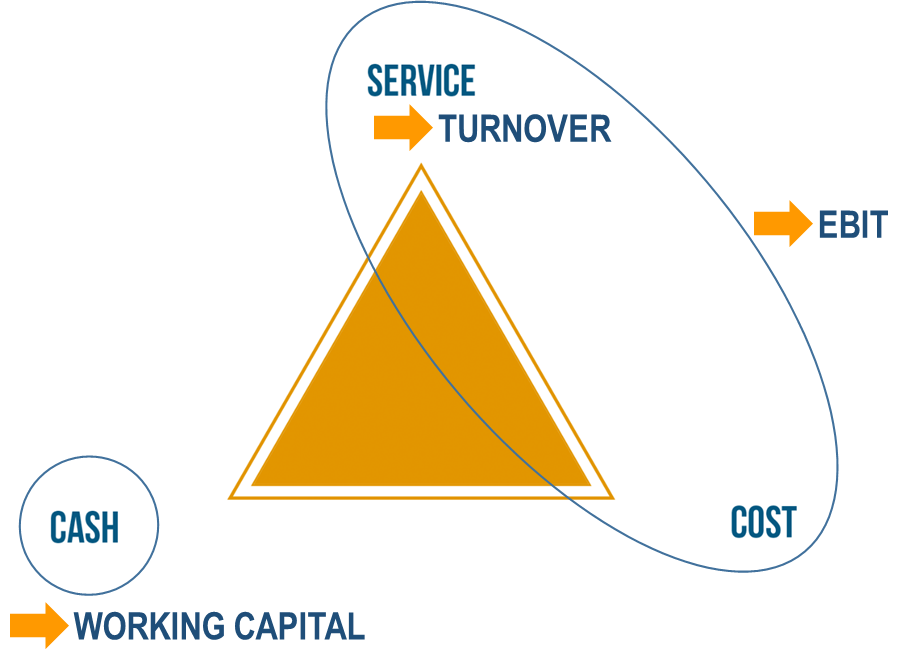

In my previous blog “Balancing Cash, Cost and Service: The Supply Chain Triangle” I have introduced that in essence supply chain management is about balancing the service, against the cost and the cash required, cfr. Figure 1.

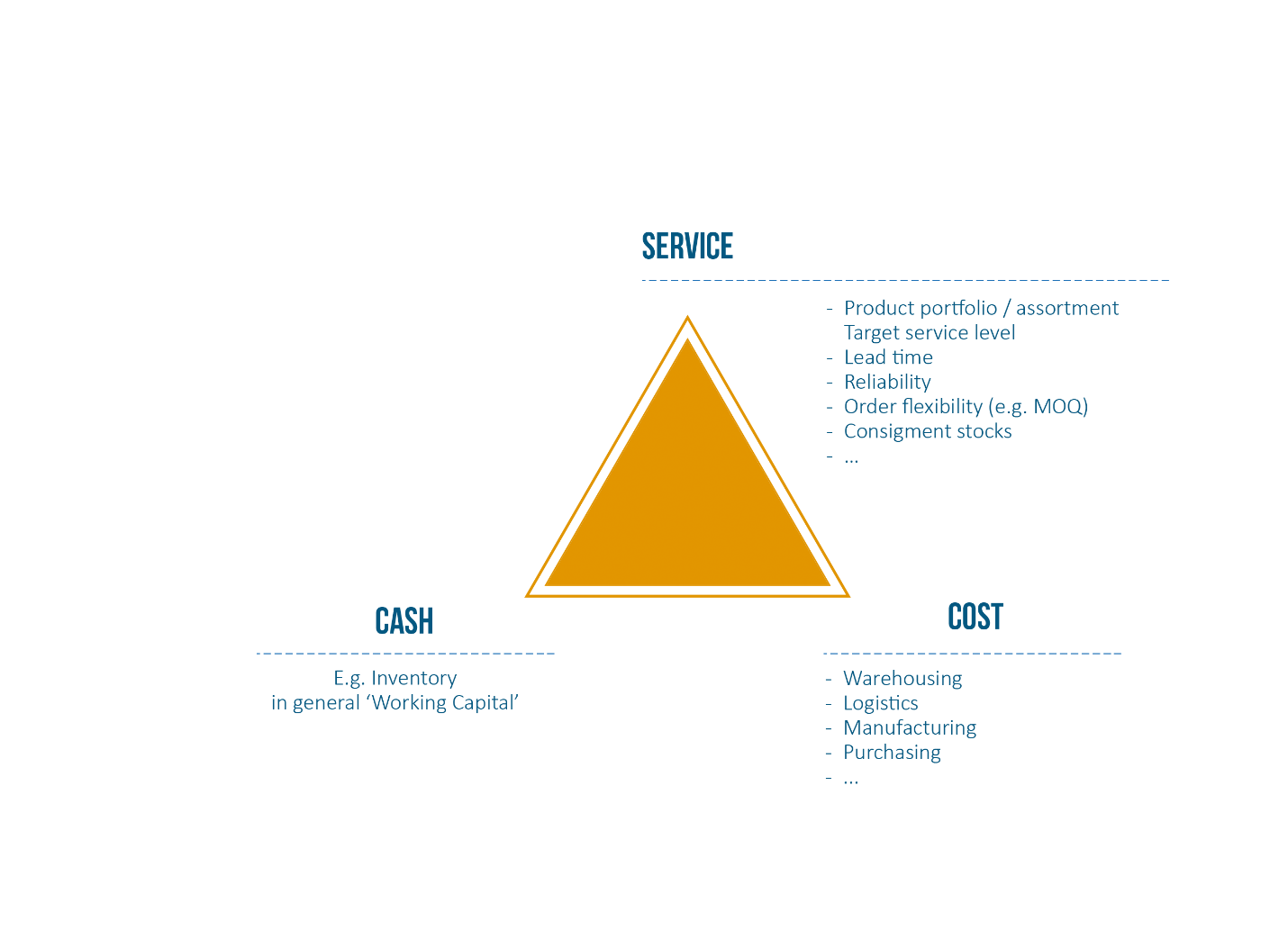

Service aspects include the number of SKU’s in the portfolio, the lead times you offer, the flexibility to offer, … More service typically drives more cost and more inventory.

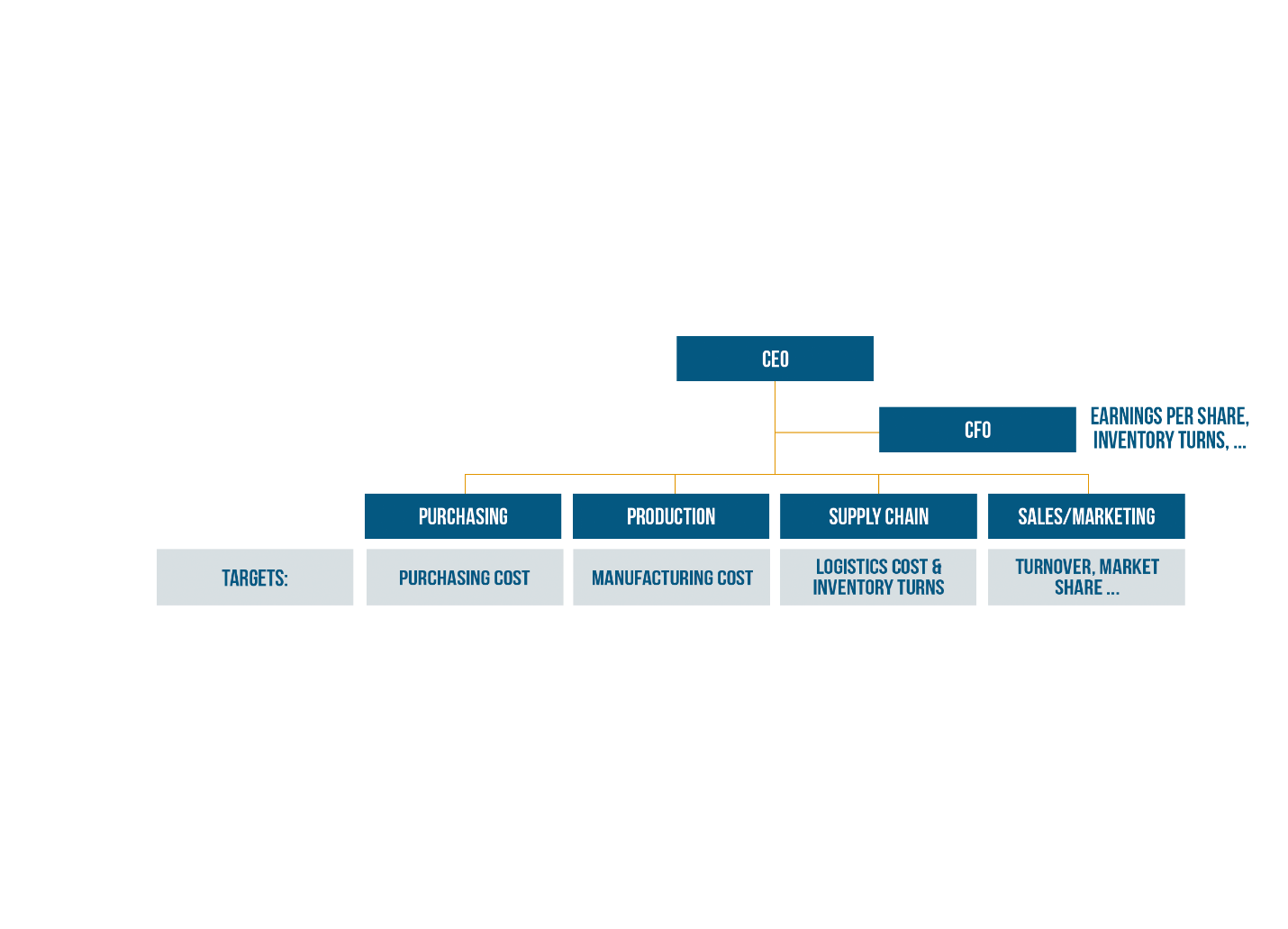

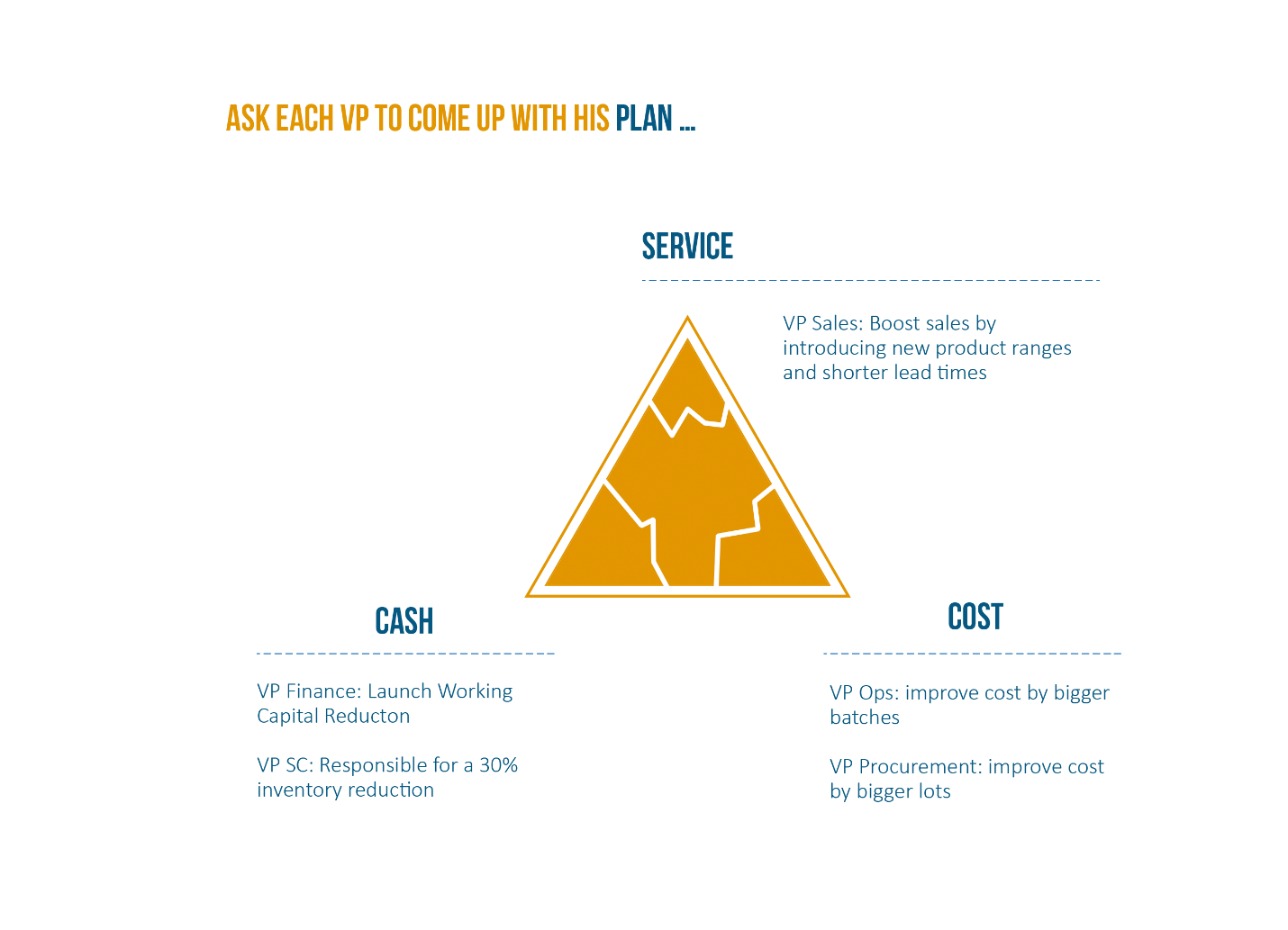

We also introduced that in many organizations, the primary focus of the functions is on functional KPI’s, as shown in Figure 2.

Sales is focused on turnover and market share and will heavily pull the service side of the triangle. Manufacturing and procurement are focused on cost, which may result in long production runs or large minimum order quantities driving inventory up. The CFO may be left frustrated with large inventory swings resulting from the unbalance in the triangle.

In a future blog ‘Financial Bench-marking for Inventory Turns and Working Capital’ we argue that balancing the triangle is about maximizing Return on Capital Employed. It is summarized in Figure 4. As an investor I’m not concerned with growth, market share or revenue as such. At least in the mid-term the revenue should drive EBIT. Not only should it drive EBIT, it also should drive a high EBIT in relation to the Capital Employed.

As such, investors are typically looking to maximize the ROCE, the Return on Capital Employed, which is defined as

ROCE = EBIT/Capital Employment

with the Capital Employed = Working Capital + Fixed Assets.

To use the words of Lora Cecere, we are not only looking for strength in performance in each of the corners. We are also looking for balance. That balance is captured by the ROCE as a financial metric.

The Need for Balanced Supply Chain Careers

The typical career is still a ladder. We have seen many executive teams that show a lot of strength, but a lack of balance. The VP sales has built his career in sales. He is an expert in sales, but lacks understanding of the complexity of supply chain. As a result he has little interest in forecasting or portfolio management. The VP of operations has built his career in operations. He is an expert in turning around a poorly performing operation. He breathes quality. He learned how to scale operations. But his years of internal focus make him underestimate the complexity and speed of today’s markets.

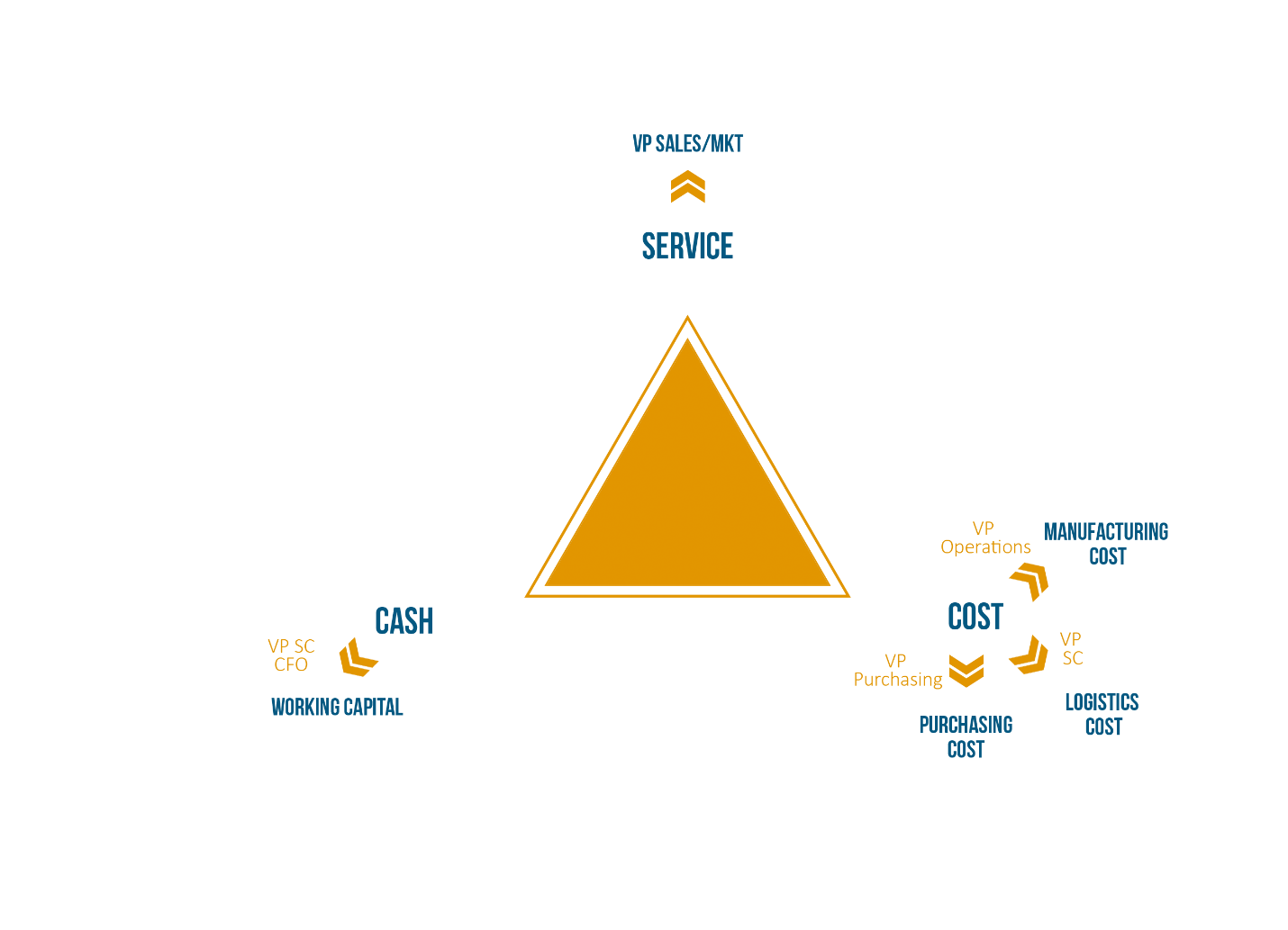

We have seen many executive teams that seem like strangers to each other, coming from different cultures and speaking a different language. A strategic plan in this type of team may look like the one shown in Figure 5. Isolated targets on each of the corners that are not adding up.

So for sure, a balanced supply chain triangle, requires a balanced career. We’d encourage companies not to accept people in senior positions unless they have worked on the different angles of the supply chain triangle. It’s not a luxury, or something optional. It is a requirement to optimize ROCE in today’s turbulent markets.

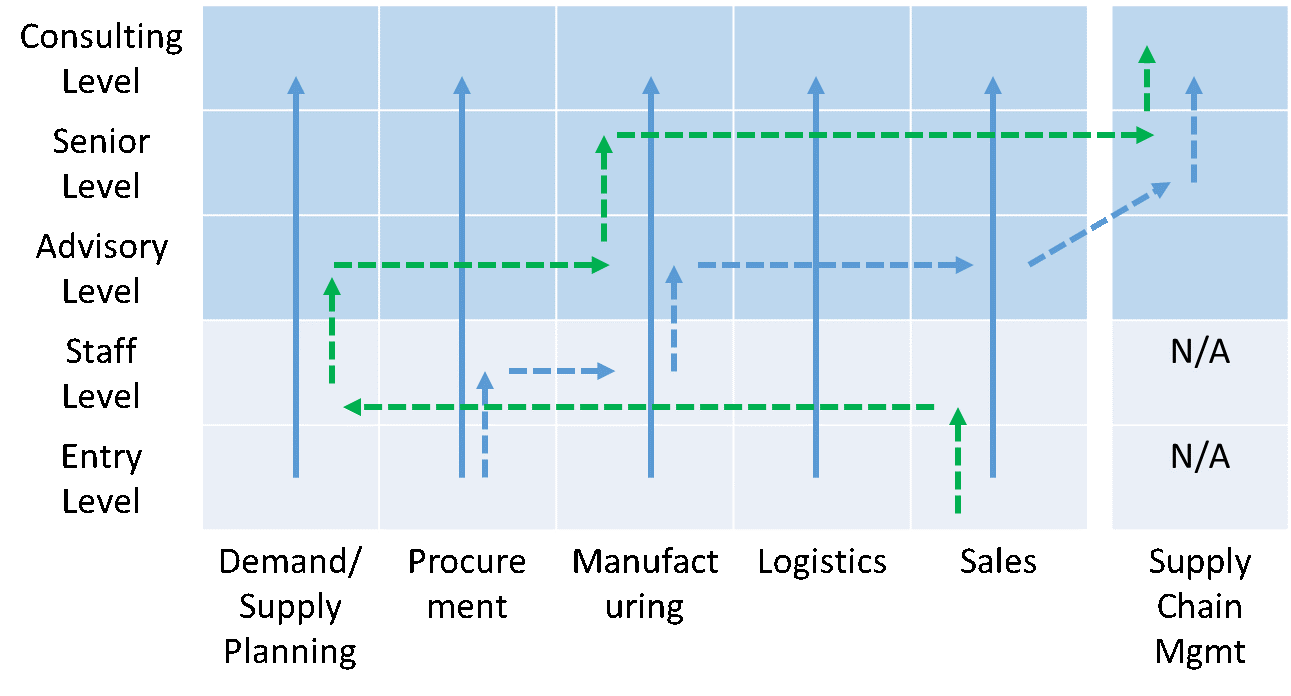

Figure 6 is summarizing this requirement for balanced supply chain career paths. The full arrows are the traditional vertical supply chain career paths. The dashed arrows are the required balanced supply chain career paths. The graph is adopted from Dischinger et al. (John Dischinger, David J. Cross, Eileen McCulloch, Cheri Speier, William Grenoble, Donna Marshall. The Emerging Supply Chain Management Profession. Supply Chain Management Review. January/February 2006.)

Balanced supply chain careers will create a different level of understanding when defining strategy in the boardroom. We will be able to come up with balanced targets. Balanced supply chain careers will support thinking in ‘total-cost-of-ownership’ and ‘good versus bad complexity’. Good complexity is the one that generates value. To understand value, we need to understand the total cost.

In summary, we believe that when building your supply chain career, you should build in lateral moves. Growing both horizontally and vertically will give you the necessary skills to build the supply chain of the future, which is balancing service, cost and cash, in order to maximize ROCE.