If you are running a manufacturing or distribution business, you have to deal with inventory. In supply chains, inventory acts as a shock absorber just like the ones in your car. If there were no shock absorbers in your car, you would feel every bump in the road. Similarly in a supply chain you would have a very bumpy ride without inventory to absorb at least some of the variations. So, not all inventory is bad. However, if you have inventory, parts of it are probably more at risk of obsolescence than others. Here are three simple analyses to determine how severe that risk is in your inventory.

Analysis 1: Match ABC classification on your demand items to your inventory positions

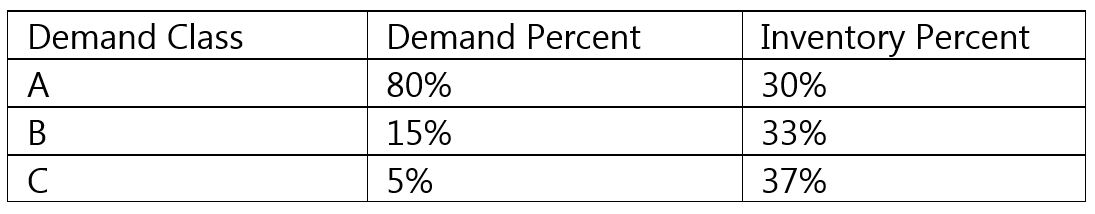

Do a classic Pareto or ABC analysis on your item demand over the last 12 months. The classic percent split is 80-15-5 but feel free to tweak it. Now, add up all the inventory on items that fall in the A category. Repeat for B and C categories. Create a table like the one below.

If you are like most businesses, the inventory percentages will not be aligned with the demand percentages. In fact, a lot of businesses have a majority of their inventory on C items. This raises the question: If 80% of the demand is on A items, shouldn’t more of the inventory also be on A items. If your inventory distribution is anything like the table above, then you are carrying risky inventory. If this is the case, it will take quite some time and effort to rectify the situation.

Action Item: Do an ABC analysis like the one shown above on demand and then match the inventory data to it. Compare the results.

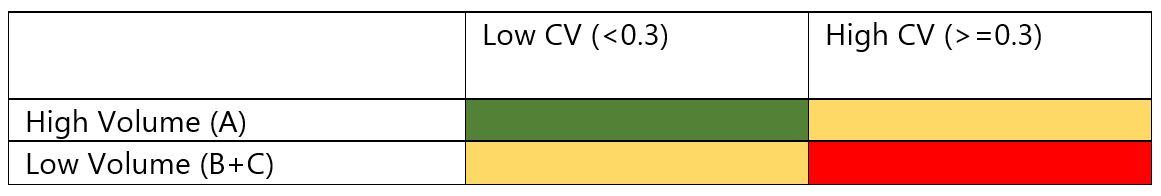

Bonus Analysis: Calculate the CV on your demand data (see my post on CV here) and then plot the inventory in a Matrix format (see below). In this case, the inventory is riskier in the red box than the yellow box. The inventory in the green box carries the least amount of risk. (I did a 2 by 2 matrix, but you can do a 3 by 3 matrix as well.)

Analysis 2: Do an analysis of order count

Suppose you have items that you sell every day of the month, multiple times a day. You likely have these items’ inventory profile in your memory and very likely do a good job of managing these ‘top-of-the-mind’ inventory items. In any case, this inventory is less risky because there is a good chance that you will get ample opportunities to work it out of the system. The one risk it does have is the following: because it is such a popular seller, your procurement strategy might be to acquire large quantities in one go. What-if something happens in the market place that makes the technology obsolete. One day it is selling like hot cakes, the next day no one wants it. You might get stuck with all that inventory. Luckily, such dramatic shifts are not so common (but not unheard of). So, the guidance would be stay prudent and not overstock the items.

Contrast that with an item that is equal in volume, but the order count is very low, say once or twice a month or once every other month. Even though the volume is the same as the example mentioned above, any inventory on this item is more risky and there is a good chance you might get stuck with it. For example, what if you procure the products two weeks too early. Or, what if that sporadic order does not come in for 3 more months? In both these cases, the average daily inventory number goes up, thereby increasing your inventory investment. And there is always the small chance that the demand just dries up and you are left dealing with that inventory.

Action item: Find out what percentage of your items have low order counts per period. How much inventory do you have on those items?

Analysis 3: Do an analysis of customer count

This one is similar to the one above and yet it is different in that it does not need to be looked on a per period basis. If many customers buy an item, then I suppose you will see lots of orders and the law of averages will take over. So the risk involved with the inventory is low and similar to the risk involved with the case above with a lot of orders.

However, if only one or two customers are buying a product, then you run a bigger risk. What if those customers start buying from another seller? What if they want to cut a hard bargain for themselves and negotiate a very low price? What if they simply go out of business? In all these cases, you might be stuck with the inventory for a long time.

Action item: Find out what percentage of your items have low customer counts. How much inventory do you have on those items?

Do you have your own favorite analysis for risky inventory? Please share in comments section below.

Like this blog? Please share with colleagues and also follow us on LinkedIn or Twitter and we will send you notifications on all future blogs.