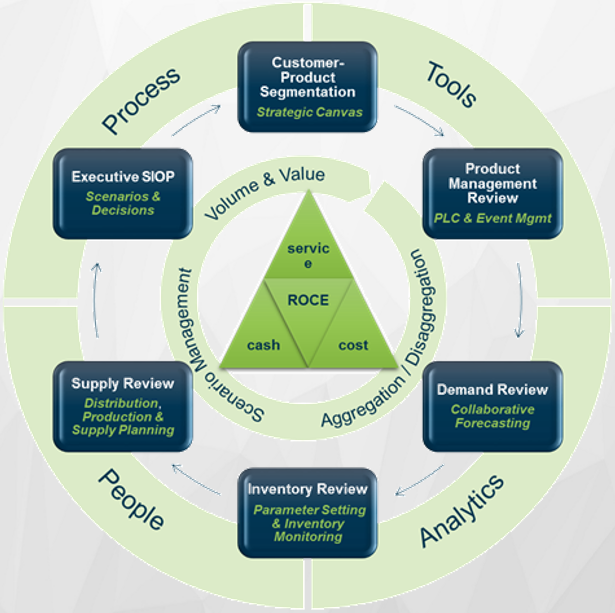

I pride myself on being an expert in designing and implementing Sales, Inventory and Operations Planning. Companies that have a good SiOP process can’t imagine how to live without it. It is the key instrument for the CEO to navigate the business along the budget towards its strategic targets. In Part One of the SiOP series of blogs we’ve distilled from the many projects we have done over the last 10 years.

A cross-functional process: from Segmentation to the Exec SiOP Meeting

Segmentation

Not every customer is equal. Not all of them have the same requirements, not all of them can be top priority. Some bring a higher volume; others may bring a higher margin. Not every product is equal. Some of them are more strategic or easier to produce. Some of them can be customer specific, others are easily substituted by an alternative. There is no one-size-fits-all in your supply chain. Segmenting customer and products, and differentiating service across those different segments is crucial in many ways:

- It clarifies strategic choices: what is more or less important

- It will put your supply chain at a more effective use

Segmentation links into all of the subsequent steps of the SiOP process:

- With A-customers we may do collaborative forecasting or VMI

- For A-products we may define higher service levels and carry more inventory

- In a constrained capacity situation, it is essential to reserve capacity for A-customers and A-products, and push out C-customers and C-products

If you skip the segmentation step, you’ll typically do it ad hoc; for instance when you have a supply shortage, or you may have different segmentations in forecasting, inventory and supply that never really come together. Segmentation is ‘the’ instrument to translate your strategy to your supply chain. Without it you lack focus.

Product Management

Innovation is key in today’s hyper competitive markets. The introduction of new products consumes capacity and requires inventory. As a result, it is an essential part of the balancing of Sales, Inventory and Operations in the SiOP process.

7 out of 10 forecasts for new products are overstated. We are humans. No product manager expects to launch a failure. If we know the forecast of a new product is inaccurate, it is key to:

- Manage the risk: e.g. be prepared to have higher cost for an initial batch to reduce inventory write-offs

- Follow-up closely: 7 out of 10 products will need a downward adjustment, but that also means that 3 out 10 will need an upward adjustment. Be quick to react and adjust your supply chain accordingly. Ensure to tie product management into the SiOP cycle!

In general, we are notoriously good at introducing new products, but equally bad in stopping old and less performing products. Near the end of the life-cycle, sales are declining, because of price erosion the margin is declining even faster, but at the same time we require more inventory.

A close monitoring of this evolution and stopping products in time is essential to keep control of the complexity and put your resources, both capacity and inventory, at optimal use. Apply the principle of the ROCE: look at the EBIT generated over the invested capital (inventory). Put targets on that and stop products when they are no long living up to the expectations!

In many company’s product management is also in the lead for promotions and marketing campaigns. Promos have a high visibility so they also require a high service. On the other they cause a lot of variability and are hard to estimate. Forecasting and planning promos is essential in balancing the Sales, Inventory and Operations. Many companies can significantly improve on this aspect.

Please stay tuned for Part Two, which will cover the Demand step of SiOP.