I came into the field of supply chain management in 2004. The master project for my MBA program in that period was on ‘Collaborative Planning in the Extended Supply Chain’. Key questions to be tackled were ‘how do we quantify the benefits’, ‘how do we create mutual trust’. The breakthrough of internet technologies were assumed to drive the adoption of CPFR, Collaborative Planning Forecasting and Replenishment.

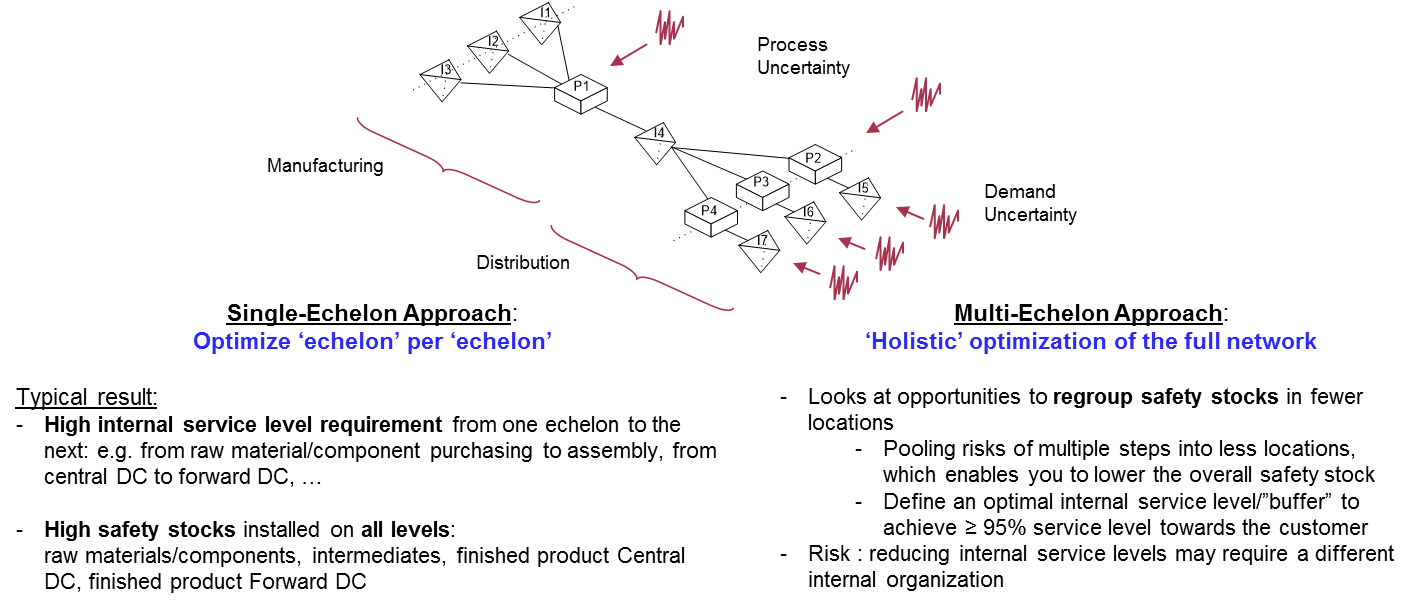

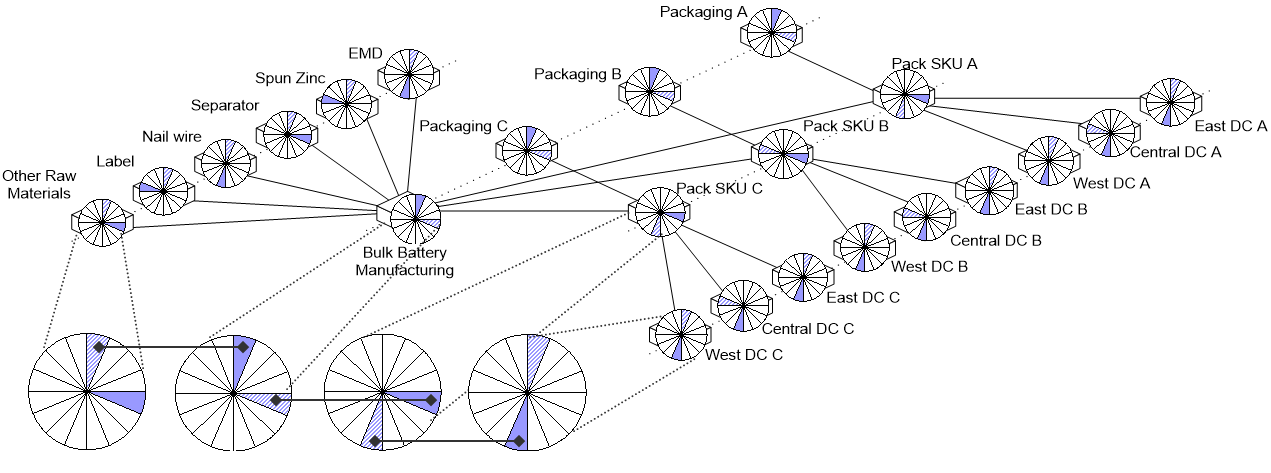

2006-2009 I did a PhD on Multi-Echelon Inventory Optimization. It certainly helped me to define the ‘business case’ for collaboration. Basic principle of Multi-Echelon is we need to let go of a ‘local’ or ‘echelon per echelon’ optimization and adopt a ‘holistic’ or ‘network view’.

My PhD was on safety stock optimization. Instead of targeting high service levels from one echelon to the next, and buffering local uncertainties by local safety stocks, you try to regroup uncertainties in a limited number of locations. By letting go of the internal service agreements, you can pool risk and lower the safety stock requirement. It’s counter-intuitive at first, but you don’t want to duplicate safety stocks, right?

When it comes to cycle stock, which is influenced by the applicable lot sizes, a similar holistic view is required. Instead of having a local rationale where each step in the chain is defining its own optimal lot size or re-order frequency, you look at how lot sizes across echelons match up and try to benefit from synchronization.

The benefits from multi-echelon adaption are always convincing. Reducing safety stocks with 30% is common. Reducing cycle stocks and ordering/change-over costs with 30% as well. The benefits are higher as the complexity of the network increases.

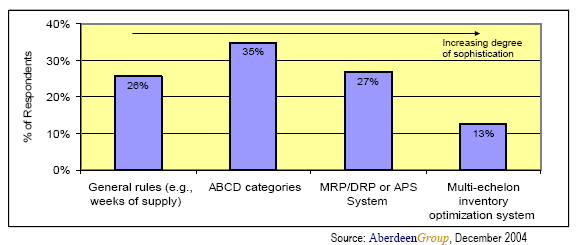

Though benefits are clear, multi-echelon inventory adoption has been very slow. Pilots within and across company boundaries have been convincing, but we have not seen a widespread multi-echelon inventory adoption. A research report from the Aberdeen Group reported a 13% adoption in 2004. My gut feeling is that today’s figure is not necessarily much higher.

Also read the blog post from my colleague on whether your business needs Multi-Echelon Inventory Optimization.

Why is multi-echelon inventory adoption limited?

Can we take a lesson for other advanced analytics tools?

- Multi-echelon is counter-intuitive. Since my first simulation results in 2006, indicating it’s better to push out safety stocks towards the customer facing echelons, I have been fighting with people for them to accept the conclusion.

- Multi-echelon is quite complex. You need a lot of data, which is available, but never clean. The algorithms are more advanced than the simple safety stock or EOQ (Economic order quantity). Not every organization is ready to adopt that level of knowledge.

Where 1 and 2 are a problem, they are, in the end, easily overcome. My biggest concern over the last 10 years remains how to create trust.

Trusting multi-echelon inventory adoption

Trust within the company boundaries, when it comes to optimizing inventories from raw materials, over intermediates to finished products in centralized and forward stocking locations. There is an apparent conflict with the cost focus of purchasing, the OEE focus of production, the reluctance of the central warehouse manager to push out stock and lose control.

Trust across company boundaries, when it comes to letting go of the high On Time In Full delivery target for the supplier, and measuring the stock availability on your side instead. Or when it comes to increasing dealer stocks while reducing your stocks. In many cases the increase at the dealer can easily be financed (via consignment) by the bigger reduction you have centrally. We might intellectually agree, but we’re very cautious to adopt this type of practices. Sales and purchasing are notoriously suspicious.

I see a comparable challenge for other advanced analytics. Going against gut feeling takes time and effort. Complexity requires maturity, which takes time to build and sustain. Cross borders, within or across companies, requires trust, which comes on foot.

On the positive side, companies have been investing in supply chain and analytics competence, are developing horizontal career paths to stimulate end-to-end thinking. Pressure on cash, cost and service has been steadily rising. All together it will stimulate further multi-echelon inventory adoption and other types of advanced analytics. It might only take more time than at least I anticipated some 10 years ago.