I have just started 2 customer-product segmentation projects. Though the companies are in quite different sectors, the drivers for the segmentation and the approach have a striking resemblance with earlier cases.

Drivers for customer-product segmentation

I see 2 main drivers for customer-product segmentation. A first is improving EBIT and working capital by rationalizing the current service and product portfolio. Many B2B environments lack a strong marketing function. Sales is king and tends to do everything to get the sale for their customer. The result can be a service which is spiraling out of control. It’s either supply chain or finance which typically calls that situation to a hold. The situation is the most critical in case of constrained capacity as less profitable products and customers can run away with the scarce resources.

A second driver is implementing a strategy. As will become clear, a customer-product segmentation, above all, is about defining which products and customers to grow, and which to treat more opportunistically. The guideline here should be the company strategy. A typical sponsor in this case is the CEO, who may be frustrated with a business that seems stuck in the old model. For them a customer-product segmentation is the way to ensure the right trade-offs are made and the right focus is created.

Failed earlier attempts

In multiple cases we came in after one or more failed internal attempts. Customer-product segmentation looks easy. A common situation is to find a lack of buy-in from sales. They have not been involved in the process and see it as threatening to a part of their customer-product portfolio. If sales is not in, it will never work.

I also find customer-product segmentations which are ineffective, e.g. by not having enough volume in the lower priority segment, which actually means there is no real segmentation, or e.g. by lack of a product dimension, which allows less strategic commodity products cannibalize on premium products, which undermines the company strategy and will drive the CEO mad.

A best-practice approach for customer-product segmentation

From the cases we did, we derived the following best practice approach.

Step 1: Segment customers

It’s tempting to define the segmentation criteria at the management table, but don’t jump to conclusions. It’s crucial for the buy-in that the sales people are involved right from the start. We typically start with a brainstorm on possible segmentation criteria. It is common for sales to come up with 50-100 segmentation parameters. No need to explain not all of them can be included in a segmentation model.

We typically look for a calculation model that gets 80-90% of the customers right with 10-20% of the segmentation parameters, combined with a review process where sales can upgrade/downgrade customers, based on the remaining parameters.

When segmenting customers, ensure sufficient spread across segments, both before and after the review by sales.

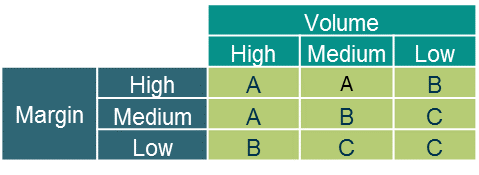

In most of the cases so far, the basic segmentation was on volume and margin, where we define a High-Medium-Low for both dimensions, and use the 9-box to define the A, B and C customers. In case required, add extra parameters to further refine the segmentation.

The customer segmentation is OK when it ‘feels good’. When sales people have been able to review their customers and the number of changes is indeed limited to the 10%.

Step 2: Segment products

In the first projects we also tried to quantify the product dimension using e.g. gross margins, but we never really succeeded. Our experience has brought us to a combination of what we have called ‘strategic fit’ and ‘operational fit’.

Marketing and product management are typically key in defining ‘strategic fit’ as high or low. A product is strategic if it shows where the company wants to be in 3-5 years time. We typically derive it from the product families and further split these by extra criteria such as product quality, specific dimensions, specific finishing, …

Production and supply chain are key in defining ‘operational fit’ high or low. If a product can be produced on only a single machine, it is made only once every 3 months, it requires a long change-over or causes a large amount of offgrade product, … then production fit is low. We derive the production fit from production and planning related data.

We use the resulting 4-box model to define A, B and C product. The product segmentation is OK when it ‘feels good’. We may need a couple of iterations before we reach that point.

Step 3: Differentiate service along customers/products

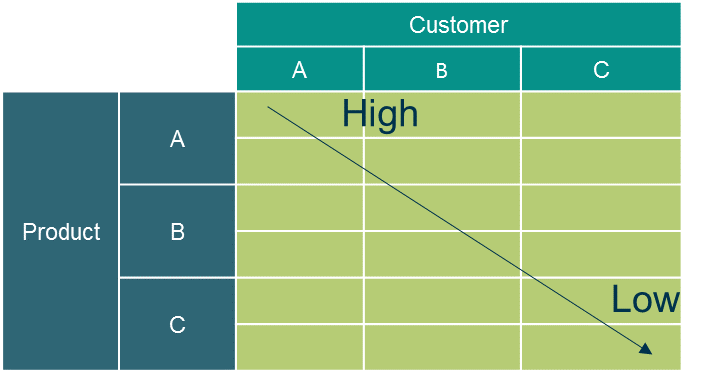

Not all customers are equal, nor are all products. In a next step we start differentiating service along the customer-product segmentation.

Will an A customer accept a lower service for a B or C product? Yes, he will. B and C products tend to be commodities. There tend to be alternative suppliers where your customer is used to shopping. Don’t be mistaken. C products tend to come in low volumes or are difficult to produce. Customers understand this drives lead times and minimal order quantities. If they ran your business, they would do the same.

When defining service parameters, make sure you differentiate between qualifiers, performance and excitement parameters (check this link to KANO classification). Only performance parameters affect your business in 2 directions. If I outperform competition, I will attract extra volumes at a better price. If I do less, I give up volume or may keep volume at the expense of lower prices.

What do we observe in practice is a lack of service ‘control’, e.g. expedited shipment of half a pallet of C-product to a non-strategic small C-customer. We also notice that the service delivered is not in line with strategy, e.g. the big volume low margin customers may get the best service and have C-product taking capacity from A-products as they get planned far in advance, cfr. the case of the steel company below.

Step 4: Simulate the impact of the service differentiation

The idea of the customer-product segmentation is to boost service for A-customers and A-products, and gradually withdraw from the C-customer and C-products. For sales managers primarily serving the C segment, this is a serious threat. They are likely to trigger the doom-scenario that ‘if we do this, we will lose that business’.

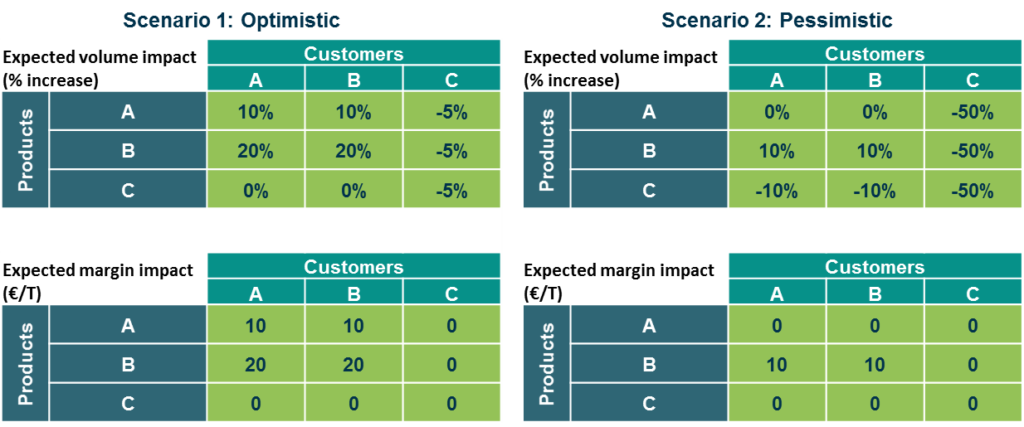

Though C-customers and –products may be less strategic and profitable, they may be important because of their volume and the resulting contribution to covering the fixed costs. This uncertainty should be addressed in a simulation. We typically run a pessimistic and an optimistic scenario. Pessimistic can be: we lose 50% of the C business, gains in the A and B are limited. Optimistic can be: we lose only 5% of the C business, and have significant gains in the A and the B business.

Analyze the impact on your volume, the covering of your fixed costs, the margin, … The table below shows the results for an example steel company we introduce at the end. Notice that in the pessimistic scenario the Margin is still improving. That has to do with the specific situation that the C-customer were negative margin customers in this case. Notice that the volume drop from 233kT to 206kT. If that is an issue to cover fixed costs, make an extra scenario where you investigate how to regain C-volume by giving extra discounts. Run scenario’s until you understand the potential leverage and the potential risks.

Importance of the supporting toolset. Don’t go with Excel.

Customer-product segmentation is more difficult than companies imagine, because of the change process, but they also underestimate the importance of robust tooling.

We have had lengthy discussions on how to define volume and margin. Should we only look backward? How far? Should we look forward? How? Include the forecast? The budget? The potential volume of the customer? How to weigh these different factors? The toolset should allow compilation of different data sources and be flexible in running different scenarios.

Input and buy-in from sales, marketing and operations is key. Easy access for input and validation is key. Sending excel files around the globe is known to be cumbersome. Ensure you have a multi-user environment where access rights can easily be defined and where reports can be tuned to an individual’s needs. It will double the adoption and halve the process time.

As discussed, easy running and displaying of what if scenarios is key. Given the amount of data that needs to be processed, excel files tend to become slow and cumbersome. Scenario’s and reports will be stuck with the single user that is capable of manipulating the master excel file.

It’s about a process, not a ‘project’. You should run your customer-product segmentation at least once a year. Linking it to the budgeting process seems a good match. Another reason to ensure you have an appropriate tool supporting the segmentation process.

Example – Steel Company

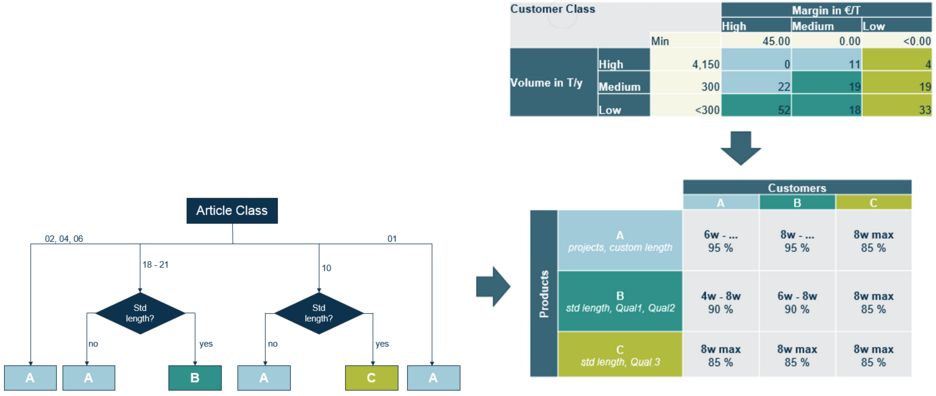

The figure below shows the resulting customer-product segmentation for a steel company. Customer segmentation was on volume and margin. The high-high segment was empty. Notice the low margin customers are all classified as C as they have a negative margin. 4 of the C-customers had a high volume. These were customers that the company had signed when business was low, not for the margin, but to ‘fill the mills’ so more for the contribution.

At the time of the project, the company had a shortage of capacity. Still these customers got the volume they requested and ultimately got the best service. Historically they had been ordering 3-4 months upfront. The idea was that these customers provided a base load and sales would try to sell the remaining capacity to higher value customers and products. In a situation of constrained capacity this is far from optimal as it may impossible to free up capacity to serve higher margin demand. We see a lot of companies trapped in this situation.

The B-items were products with standard lengths in 2 better quality steel grades. The C-product were standard lengths in a lower quality steel grade. On the C-grade the company was facing intense competition from imports. The B-product was more difficult to process providing a competitive advantage. The A-product were custom lengths, for big projects and typically directly delivered to an end customer. The B and C products were typically going to distributors. This is reflected in the reliability settings of 95% for the A-product, where a 90% and 85% reliability was chosen for the B and the C products. You don’t want to keep projects waiting, where distributors are typically carrying inventory of standard products.

Notice the ‘8 weeks max’ lead time for the C-customers and products. Where these customers often ordered 3-4 months upfront to ‘fill the mills’ the goal was to revert the power balance and ensure sufficient capacity for A and B customers and products.

The 6 week and 4 week lead time for the A-customers, for A and B product were meant to be market beating. The 4 week and 6 week lead time for the B-product required carrying inventory. Currently the company was carrying most inventory of the C-product. As customers were ordering 3-4 months upfront, a specific timing was not agreed leading to a slow call-off by the customers. Here again the idea was to revert the power balance. C-product was to be shipped when available so the limited physical and financial headroom was taken by the B-product.