With the new year comes pundit “prediction season”. It seems that anyone who can type will post their list of things to look out for. It’s human nature to look ahead and anticipate what may be. We all look back to look forward – just like a good demand forecast does. And if you think about it, most calendar-year business plans are in truth, predictions about the year to come.

At this point, we’ve all already seen many points of view about the coming year and there is a wide range of ideas about what’s to come. It seems to me that most of the thinking comes down to three common themes: infrastructure, labor/costs, and supply chain visibility/agility. Here’s my take on each of them and what they mean to you.

Infrastructure

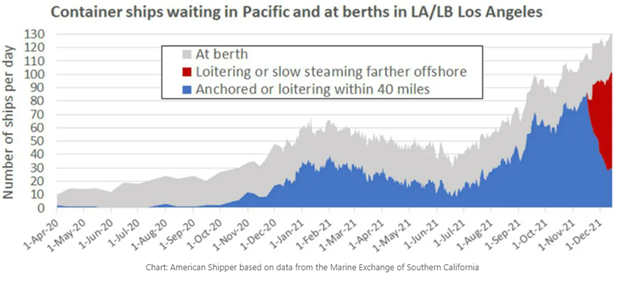

We’ve all seen images of the logjam at the ports, COVID impacted factories, and the empty shelves at our local markets. The general inability to get goods from point A to B will remain challenging for much of the coming year. In December 2021 alone, more than 100 container ships were parked outside of Los Angeles waiting to unload cargo from China. 60 Minutes recently did a feature on the port in Long Beach and it’s not just the ships backed up, but also misrouted containers sitting empty, aging infrastructure, and a lack of help.

What’s on these ships? Just about everything. I was car shopping a few weeks back and found that heated seats – a New England necessity – were unavailable. Car manufacturers are getting around the chip shortage by shorting content on autos. My decision at the dealer was to defer my purchase until next year – when hopefully, inventory levels are back to a semblance of normal and my “friendly” dealer was not marking up the MSRP to obscene levels. (More on costs further on in the blog).

For better or worse, governments have recognized the lack of infrastructure as a critical gap and are taking action. But even quick acting legislation and availability of funds for investments can take years to realize any gain in capacity. You can’t build a new port or rail lines overnight. You can’t enhance the interstate highway system to better accommodate trucking (and automation) quickly either. There’s a catch here too. By the time the new infrastructure is in place there could be a different economic reality. The working assumption is that the economy will stay strong. What if it contracts? Will it give a much-needed respite and allow things to revert to a pre-COVID normal? Or will the pandemic fade away, leading to even more euphoric rise in consumption and the resulting ongoing supply chain challenges?

For the short term, there will be a trend toward onshoring and localizing supply. But this will create other headaches such as increased costs (covered below) and more complex supply networks. (Less hub-and-spoke and more regionalization/suppliers). The net result is that planning will be more intricate than ever before.

Labor and Costs

As many have read, there is a “big quit” happening in the US economy. No sector is immune to individuals leaving the workforce – or moving on to greener pastures. Nearly a quarter of the trucking workforce is expected to hit retirement in the next decade, and according to the National Transportation Institute these retirements will accounts for 54% of the driver shortage. Office (or work-from-home) personnel are also in short supply for key roles in planning and forecasting. This puts pressure on manufacturers and retailers to pay more and compress margins and/or raise prices. So, who is making out in this chaotic environment?

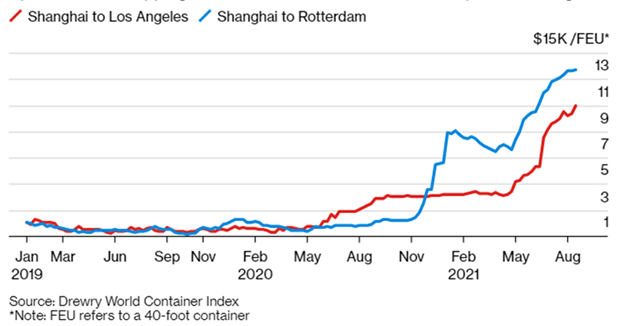

Shipping giant Maersk is doing quite well. Their revenue is up 67% and net income is up an astounding 486% at $5.4 billion dollars. At the root of this is a decades-long migration of jobs to China, the pandemic cutting production of all items, and not enough ships to meet pre-COVID levels. Rental prices per ship can be blown out to $200,000 a day, and some brands are paying a premium to move product by air—in 2020, Apple chartered 200 private jets to ship devices. I hope they were not flying business class. I cannot afford it. I hope someone’s iPhone cannot either.

In the end, the consumer will be paying more for basic goods as the cost to transport materials will trickle down to the “lowest point”. Without fixes to the labor market and infrastructure, there is a lot of risk to continued economic growth in the post-COVID world. In 2022 we’ll have a clearer idea of where things are going but we may ultimately not like the direction it takes.

For example, if inflation is not a “blip” but a long-term result of pressures on supply, then the economy may slow or even drift to recession. If the pandemic continues with new variants, we’ll see more “panic-buying” for staples. Even now there are partially filled shelves at my supermarket and the cost of groceries continue to creep upwards. This continued uncertainty required planners to do a lot of what-if and scenario simulation to be able to meet objectives. The ability to get it right – especially manually – is a monumental task.

Agility, Resiliency, and Visibility

Those of us on the “business-end” of the supply chain must contend with the fallout of infrastructure and shipping challenges on a daily basis. Agility, resiliency, and visibility are essential to ensuring success. Consider this:

- According to Forbes, more than 90% of supply chain executives said visibility into their supply chain is important to success, but less than a third have achieved true visibility.

- Capgemini Research Institute reported that 62% of respondents to an industry survey stated supply chain resilience would be a key priority.

- And Chris Andrews, Supply Chain Transformation Leader, EY UK says “in 2022, we expect businesses to … improve end-to-end visibility and better enable risk management and decision making when it comes to their supply chains. There is a recognition that the volatility and disruption witnessed in recent years will continue to be facts of life….”

All three of these themes affect demand forecasts and the ability of businesses to contain costs and meet customer demands. At the end of the day, the job of those managing the supply chain does not change. Regardless of the challenge, we must keep the shelves stocked and try to eliminate money wasted in inventory that does not move. To quote an (very old) SNL skit, “if it’s not one thing, it’s another”. Fortunately, despite the volatility and complexity of the supply chain in 2022, technology seems to be keeping pace. The tools at the disposal of those who need to make the right inventory bets have never been stronger. With these tools, planners can do more with less – somewhat muting the impact of labor shortages. These tools also provide more end-to-end visibility into what goes into inventory movement and gets us all closer to a range of possibilities that will meet demand.

We are never going to be able to contain weather or health events. We’re not going to be able to fix infrastructure in months. However, we can provide the tools that make supply chain work rewarding and desirable. Our 2022 prediction at Arkieva is to continue to innovate and make it easier for our customers to work smart and be successful.