Picking up from where I left off in my previous blog, I will look at a few more scenarios in both short and long terms in this blog. Even though Brexit is the theme for these scenarios, the underlying principles apply to any situation with uncertainty in supply planning.

What if a purchase cost post Brexit goes up (due to tariff change)?

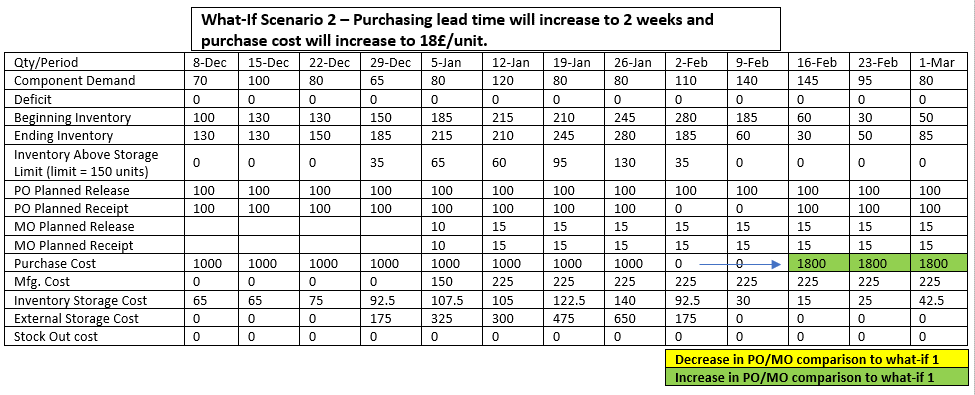

One of the likely impacts of Brexit is a higher tariff on imports. Considering the same example and model as in the previous blog (of component ABC) and as a follow-up to the two scenarios discussed there (baseline and lead time increase to 2 weeks), let’s assume that the tariff change will increase the purchase cost of the component by 8£ per unit (it is assumed to be 10£ per unit currently). To evaluate the impact of the increase in purchase cost, the planner will need to update the purchase cost to 18£ per unit beyond Jan-31 and run a new scenario.

The table below shows the new recommendations. When compared with the previous scenario (lead time increase), there is no change in PO or MO recommendations, the only change is with the purchase cost in the last 3 weeks. This is somewhat expected because meeting demand is imperative (given a very high stock-out cost) and the model is not going to NOT order to save on purchase cost and let the demand go unmet.

How can What-If Scenario Planning Help Plan for Brexit – Part 2

What if in-house manufacturing can ramp up capacity?

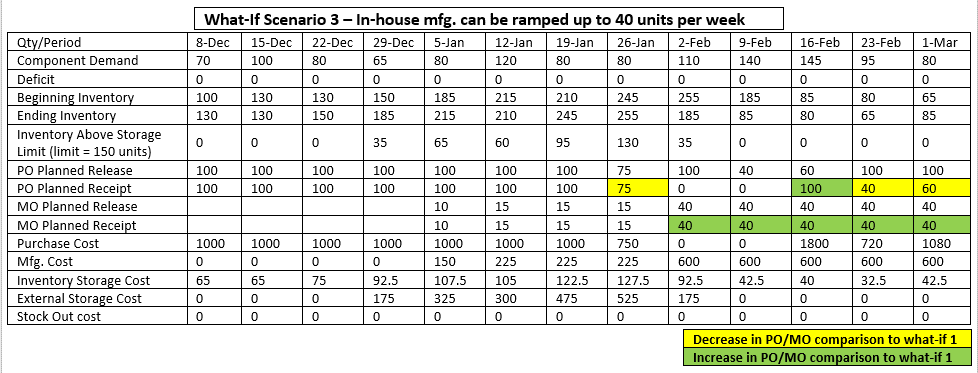

To avoid spikes in the purchase cost, there may be a way to get the in-house manufacturing team to ramp up capacity and reduce purchase quantities. Let’s assume that the manufacturing for component ABC can go up to 40 units per week from the week of 02/02 as against the limit of 15 that was initially stated. To evaluate the impact of this change, the planner will need to update the relevant capacity master data and run a new scenario.

The result is an altered PO/MO recommendation. Highlighted in green (increase) and yellow (decrease) in the table below are the differences when compared to the scenario where only the lead time was increased. Following are some inferences:

- The model has basically used up all the additional mfg. capacity available from the week of 02/02 and reduced the POs by equal amounts.

- While the total mfg. cost and inventory storage costs have gone up, the total purchase and external storage costs have gone down, bringing the overall cost down.

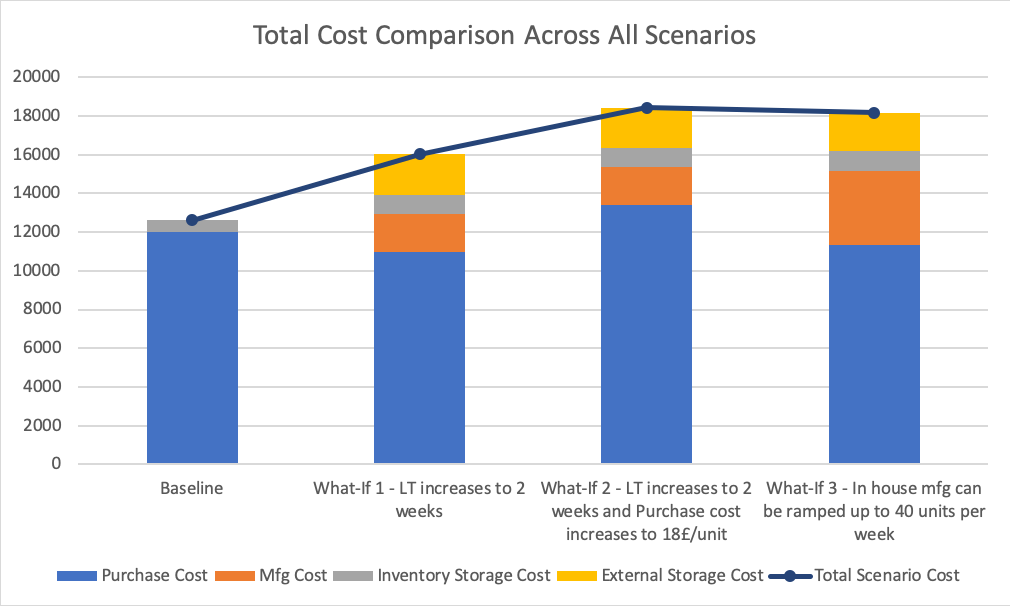

Total Cost Comparison

The chart below depicts how the total cost has varied across different scenarios. The baseline is without considering any impact due to Brexit and all the component requirement is being purchased. What-if scenario 1 considers the situation where the purchase lead time will go up due to Brexit and the recommendation is towards using inhouse capacity and opting for external storage to ramp up inventory before the deadline resulting in an overall increase to the total cost. What-if 2 looks at tariff increase (apart from lead time increase) which results in even higher total cost while what-if 3 takes into account the possibility of ramping up the inhouse capacity to offset an increase in purchase cost which results in a slight reduction in overall cost when compared to former. There could be other measures that could be evaluated to bring the overall cost down.

In general, for any scenario, if the model being used is a cost optimization model, i.e. minimization of cost or maximization of revenue, then the recommendation will automatically consider all the trade-offs that exist in terms of costs (for example – order well ahead vs on-time or using in-house capacity vs relying only on external vendor or using external storage vs meeting the demand late and many more) and provide a recommendation that is best in terms of the overall cost.

Longer-term decisions

What-if scenarios can be effective to evaluate longer-term decisions as well. Typically, there is also a long-term planning team in an organization that is solely focused on strategic decisions and is also integrated with the short-term planning team. As for the planning software, the short-term plan should be input into the long-term planning module since some decisions have already been made in the shorter term and it is best used as a starting point.

Some of the scenarios that could be evaluated by the long-term planning team in lieu of Brexit are:

- To smooth out costs or to keep the overall costs at acceptable levels, there may be a need for alternative suppliers outside of the EU or even within UK. With an appropriate model (one that replicates the business in the long-term) this can be easily evaluated.

- If the decision is to stick to existing suppliers, then one thing to consider would be the need to review the safety stock levels and EOQs (due to increased lead times and corresponding uncertainties).

- It is also important to note that the demand for the finished product being produced could also be significantly altered due to Brexit as the EU is the major receiver of UK’s exports (about 50% in 2018 as stated above). Any potential impact of demand change will need to be evaluated on the supply side as well.

Supply Chain Planning in the Times of a Trade War – Part 1

There could be many more scenarios evaluated, for short- or long-term impacts, depending on the nature of the business and scope of the situation on hand. In general, what-if scenario planning has immense utility and can drive a business in the right direction in the face of uncertainty.

Enjoyed this post? Subscribe or follow Arkieva on Linkedin, Twitter, and Facebook for blog updates.