- Do others challenge your expanding portfolio or complicated offering?

- Need a portfolio pruning process or policy to keep a manageable inventory?

- Want to take the drama out of keeping or deleting products?

Remember, SKU creep adds to the complexity, adds to inventory, and ultimately costs to deliver.

Read More: Who Should Take Ownership of Finished Product Inventory Management?

Use this collaborative six-step process to shape up the portfolio.

- Download shipments, forecasts, and financial data

- Add descriptive statistics for the data element of interest: item_location_customer

- Review with Sales and Marketing

- Negotiate and document assumptions

- Slice and Dice Data to check final agreed-upon levels

- Rinse and repeat every 180 days

1) Download shipments, forecasts, and financial data

Create an arsenal of knowledge based on the facts:

- Download shipment history to Excel by item_location_customer for up to 36 months depending upon the business. Three years of history helps determine trends for a seasonal business and volatile businesses need focus on the current year. Remember, even if you ship directly to the customer, the basic data element to consider remains the item_location_customer. It forms the basis for aggregation to product families while providing the detail of customer shipments.

- Download forecast data in the same manner. This allows aggregation by a customer as well as product families. Depending upon your software, collect bias, forecast error, and graphs.

- Collect financial data from your local finance officer. You should ask for Cost of Goods Sold, meaningful price data, as well as inventory in dollars. Note: Price-COGS would be a rough estimator of revenue.

Note this is an Excel approach which involves manual data cumulation, using an integrated, advanced planning system will avoid the need for these manual steps.

2)Add descriptive statistics

To give meaning to the review, apply relevant descriptive statistics alongside shipments and history. This provides fact-based grounding.

- Show product families, warehouse, who buys, and basic product descriptions. In addition, display these descriptive statistics mentioned in previous blogs, at the data element item_location_customer:

- ABC code from Product/Customer Matrix

- Coefficient of Variation >>COV<<(Std Dev/Mean): from the variability of the demand stream

- Average Demand Interval >>ADI<<(12/No. of months sold in 12-month period)

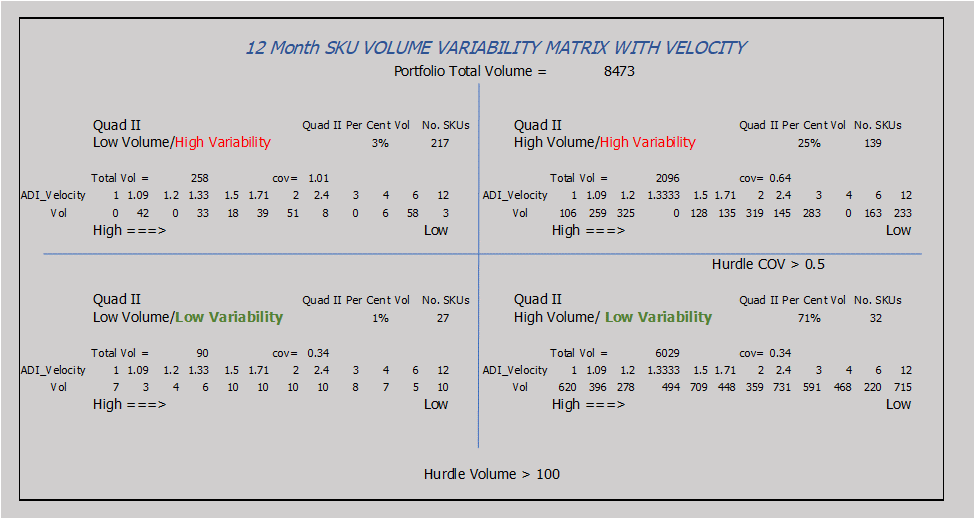

- Volume/Variability Matrix: Negotiate a ‘hurdle rate’, or threshold for monthly sales by product family and a COV ‘hurdle rate’ (typically 0.3 or 0.5). See Fig. 1 for an example.

Fig. 1 Volume Variability Matrix for SKU Pruning

If you consider the above minimum essential, then customize with the following, at the SKU level:

- Show the last three months of shipments alongside the next three months of forecast

- List strategic customers buying and number of ship-to customers

- Document the replenishment type: Make to Stock, Make to Order, Re-Order Point, etc.

- Show stock out history (keep a record of weekly stock outs and calculate frequency: No. of stock outs/No. of weeks) If significant, for Quad I & II SKUs, seek remedies with Operations as you’re losing revenue.

- Show Price-COGS for both last three months shipments and next three months forecast

- Create your own bespoke statistics to fit your business whatever it may be

3) Review with Sales and Marketing for realism

Review your data with the Sales/Marketing and fend off all challenges with descriptive statistics. Here’s some you might face:

- If the SKU ADI = 6, in Quad III, you might want to ask, why invest in a product that sells once every 6 months with high variability and low volume? Also, ask if you can convert the customer to another product OR ship out of a different warehouse (new SKU).

- If the product shows no shipments in the past 6 months, why keep it? However, if it’s a new product that is yet to launch, then document for next review.

- For SKUs in Quad II with high variability and high volume, consider collaborative planning with customers to lower variability.

- If the SKU crosses the line into BAD SKU territory, consider sourcing out of another warehouse to keep the item. Delete the item when all else fails.

4) Negotiate

No matter how sophisticated your analytics, NEVER ignore Market Intelligence. When Sales wants to keep a product, challenge their concerns but be realistic. It’s their finished product inventory to sell and their inventory carrying costs. Just remember every SKU kept that does not sell adds to inventory and cost to hold.

Create hurdles for Good SKU / Bad SKU: Examples

| Descriptive Statistic | Good SKU | Bad SKU |

| Velocity (ADI) | <1.2 | >4 |

| Volume (Hurdle rate) | X1 Kgs per month | Y1 Kgs per month |

| Variability (COV) | < 0.3 | >0.5 |

| Strategic Customer | Yes | No |

1=Choice of Sales/Marketing

5) Slice and Dice Data to check levels

Show SKUs in volume and dollars (Cost of Goods Sold) by groups of:

- Product family

- Strategic Customers

- Quadrants (I-II-III-IV)

- High Volume (Quads I & II) – Low Volume (Quads III & IV) – High Variability (Quads II & III) and Low Variability (Quads I & IV)

- Frequency of Stock Outs

- Warehouse

- SKU and Ship to Customer combination

- Your bespoke set of descriptive statistics (be prepared to customize the pivot table in front of Sales/Marketing …. this only adds to your credibility).

Slice and dice by data element to capture multiple views. Consider new dashboards to keep SKU proliferation in check.

Read More: A Six-Step Process for Demystifying Your Safety Stock Process

6) Rinse and Repeat every six months

Things happen and as you’ll soon find out from Market Intelligence (it’s not an oxymoron), you need to keep up with the changes to kill off the inventory of old product and quickly launch the new. 180 days may not fit your business, so consider what makes sense to you.

Q. If all these steps, which is the most difficult?

A. Step 3 by far. You need to create buy-in for this important process. Keeping old SKUs beyond their time adds to cost to deliver. Communicating product launches to planners and operations ensure success. Planning for both is good hygiene for the business.

Enjoyed this post? Subscribe or follow Arkieva on Linkedin, Twitter, and Facebook for blog updates.