When it comes to inventory optimization, companies often have to play a delicate balancing game to ensure that they have optimal levels of inventory. If your forecast numbers are too high, you run the risk of holding costly excess inventory and reducing available cash on hand. If your forecast numbers are too low on the contrary, you may be ridden with a loss in possible sales and disgruntled customers due to a stock out. Making inventory optimization, arguably one of the most difficult tasks for any manufacturing business.

I’ve always had a fascination for inventory optimization; so much that I completed my Ph.D. in multi-echelon inventory optimization. I’ve always been puzzled by why more companies are not adopting multi-echelon inventory optimization given the economic turmoil, and the need to keep operational costs as low as possible. What even amazes me more, is the disbelief and objections that I encounter still today, after ten years of implementing multi-echelon solutions.

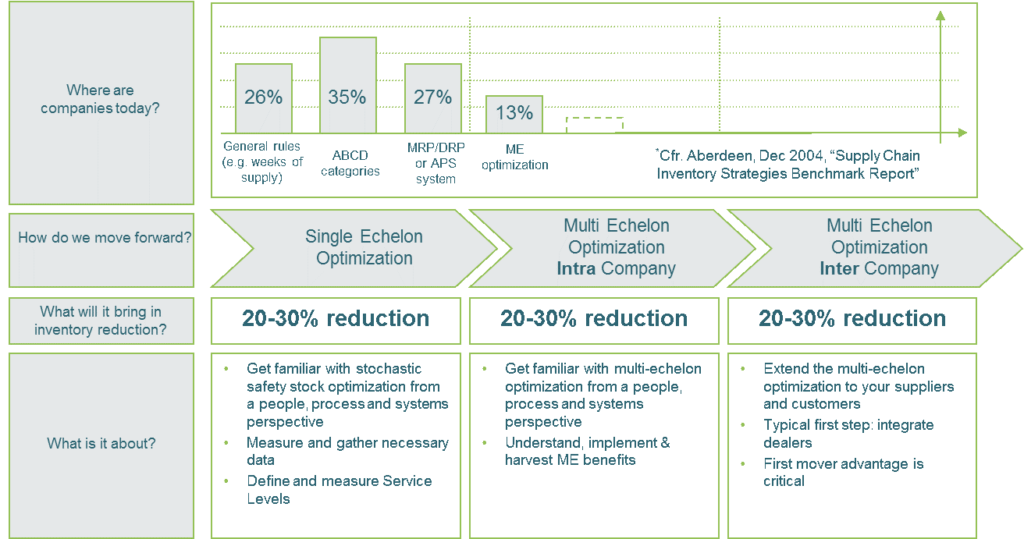

For global companies, there is the need for creating a true end-to-end supply chain that eliminates supply chain silos in business divisions, and implementing a multi-echelon inventory optimization process can aid with this goal. To begin the discussion on how to reduce inventory costs with a multi-echelon inventory process, there is the need to understand the difference between multi-echelon and single-echelon inventory.

In a single echelon inventory optimization, demand forecasts are calculated to determine safety stocks and lot sizes are based off a single echelon (stage/business unit) view. In a multi-echelon inventory optimization, however, a more holistic approach is taken to ensure that safety stocks calculations are done in a more global or regional fashion – balancing stocks across different echelons to reduce costs of holding excess inventory.

3 Key Challenges in Implementing Multi-Echelon Inventory Optimization

By definition, multi-echelon provides an unprecedented advantage to businesses looking to free up working capital and optimizes existing production processes. In fact, we have recently applied the logic to a client in the chemical industry with a complicated Bill of Material (BOM) up to 12 levels deep, and the company is currently enjoying a savings of up to 50% after implementing a multi-echelon inventory process.

Even with the considerable success of this client, many businesses still fail to implement or adopt a multi-echelon inventory optimization due to three main reasons:

Problem #1: multi-echelon is counter-intuitive leading to a general distrust of results

Taking into account the results of the multi-echelon safety stock optimization, pushing all the safety stock out is somewhat counter-intuitive for a number of reasons. When we do seminars on multi-echelon, people will fiercely resist the result with arguments such as:

Doesn’t APICS teach you to ‘centralize’ safety stock? I thought centralizing safety stock was reducing the safety stock requirement?

The regional forecast is of such poor quality?! Doesn’t it make more sense to keep the safety stock at the central DC so we can still decide where to send it? If I send it to the RDC based on their forecast, I will always have too much in some and shortage in another.

Are you pushing out our inventory to the most expensive part of the supply chain? That is especially frightening!

Solution: Learning to understand how multi-echelon makes a difference

In general, we answer the concerns that our clients or potential clients have by saying yes, the central demand is more stable, or the central forecast will be more accurate, but that doesn’t mean that’s where you should put your central safety stock. Explaining why goes as follows:

The principle of risk pooling tells you that aggregating risks will lower the safety stock requirement. That is why centralizing four DC’s (Distribution Centers) into one DC will reduce the safety stock by a factor 2 (square root of 4). The pitfall is that in a multi-echelon network, the risk pooling does not happen on the central level, but on the decentral level. If you want to have a good service in the Regional Distribution Center (RDC), you will need a significant safety stock there, especially if the quality of the forecast is poor. Multi-echelon will tell you that instead of ‘duplicating’ that safety stock on the central level, you will try to aggregate all the risks of the supply chain to the customer facing echelon, where you already carry some safety stock.

In our first implementations, we were obliged to do extensive validation using discrete event simulation and using real life pilots with a limited scope. Even if people intellectually agreed, they wanted to see it in practice first before they started believing it.

Once they were convinced, they became advocates of multi-echelon, who would never go back to a single-echelon logic.

Problem #2: Setting up appropriate incentive systems and overcoming a deep distrust within the supply chain

For example, while a CFO may love multi-echelon because it allows reduction of the total safety stock by 30% while keeping the same customer service level, the manager of the regional DC may have a different view. If they need to increase their safety stock from 3 to 5 days; that’s a 66% increase. And for what type of reason? Because the central DC is taking away their safety stock, and unfortunately the regional DC manager needs to pay for that. Now imagine how this sort of debate goes if each of the DC managers has received his target to reduce inventory by 10-15%?!

Solution: Getting everyone on the same page by implementing a true end-to-end process

We have done comparable calculations for retailers where we see the following:

The shops will demand a high service level from the central DC for their replenishment. As a result, the central DC will need to keep significant safety stock. The central DC will demand a high service level from its supplier, sometimes even without sharing any forecast. As a result, the supplier will need to carry a high safety stock.

From the above examples, it is clear you can easily halve the safety stock in this type of supply chain by putting it closer to the customer. Even if the shops would not be able to take the full increase, the result will never be that each step in the supply chain keeps on carrying a high safety stock. Even if retailers would intellectually agree and if we’ve proven the result via something like discrete event simulation, they may still be reluctant to implement the result, even though the multi-echelon approach would drastically shift their inventories downstream. Again each of the echelons may have its targets on inventory.

There is also a problem of ownership, as the retailer would need to take more inventory and all of the inventory benefits would be on the supplier’s side. Moreover, what would the supplier do if they have a major outage? How would I be sure they would deliver me instead of a competitor? Next to KPI’s part of the issue is distrust. We feel more comfortable with a situation where each of the steps in the supply chain ‘takes care of their own’ instead of going to a true end-to-end optimization.

Problem #3: Multi-echelon requires more advanced tooling technology that may not be available

Many companies still use simplistic policies to set safety stock or lot size targets. Some just carry two weeks of safety stock for all items. Some refine that based on an ABC/XYZ classification. The more advanced companies calculate their safety stocks based on a formula, accounting for lead times, forecast error, lead time variability and a target service level. An Aberdeen report from 2004 shows that only 13% of companies have adopted a multi-echelon approach. Reasons for that can be the above.

Solution: Finding an advanced modeling tool

Advanced calculations require advanced tooling. Ten years ago these were the exclusive domains of innovators like Optiant and SmartOps, typically driven by academics. My Ph.D. research was in the same domain and has been made available in the Arkieva software. Over the last ten years, we have seen multi-echelon become progressively available in an increasing number of software packages. So yes, more advanced software is needed, but its availability should no longer be the threshold to implement multi-echelon.

A caveat, however, could be to ensure you don’t go with a black box approach. As mentioned multi-echelon results can be counterintuitive. Make sure the software and the integrator have sufficient knowledge to explain exactly why the software comes to a particular result. If you don’t understand, it will just be a matter of time before you turn that black box off, and you will lose all the ensuing benefits.