Here’s how you can use profit based product segmentation to improve the supply chain planning process.

These days, supply chains are getting increasingly complex. As a result, companies often take advantage of techniques like segmentation to divide up the supply chains into smaller segments. The goal of the segmentation process is to take a granular look at the different segments and apply strategies that make the most sense to each segment.

Often, this analysis is by volume and forecastability measures. But this thinking can be extended to profitability or margin as well.

Beginning the Segmentation Process: Determine Product Profitability

Let us first talk about data availability. Many companies might not have data on profitability at the SKU-Location level. However, companies generally have data on selling prices and costs in their ERP system. Some ERP systems have the standard costs, whereas some others keep more advanced activity-based costs. Regardless of the above, the margin or the profitability can be calculated as:

Profit = Price – Cost and % profit can be calculated as Profit / Cost.

Once this is done for each product, one can begin to do some segmentation.

Hopefully, there are no products with negative profit (or loss). If such products exist, one should immediately question why they even exist in the supply chain. Unless the loss on these products leads to big profits from the same customers on other products, these products should not be kept in the portfolio.

[Read Also: 8 Common Issues to Avoid When Creating a Customer Segmentation Strategy ]Product Segmentation ABC Analysis

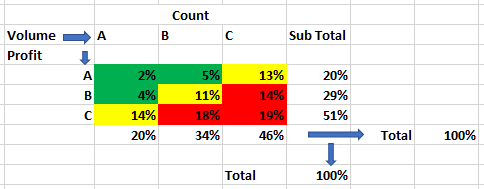

Doing an ABC analysis is the next step. The top profit item should be under the A category. It can be easily concluded that one should try and sell the high-profit items more than the low-profit items. However, the demand is exerted by the market and is not decided internally. As a result, it is possible that all the high-profit items are the slow movers. For this reason, it is helpful to crosscheck the profit based ABC to the volume based ABC. See the schematic below.

In this example, items that are slow movers and low profitability are highlighted in red and account for a full 51% of the data. This type of analysis can lead to product rationalization initiatives.

Using Product Profitability to Determine Inventory Turns

Next, let us look at inventory. The idea of Turn-Earn Index tells us that the number of turns needed for a particular product should be decided in conjunction with the profitability; that higher margin items can be managed with lower turns and lower margin items must be managed with higher turns. The turn-earn index is calculated as:

Turn Earn Index = Physical Inventory Turns * Margin %

So, if an item is very profitable, one needs to turn over the inventory less often compared to an item where the margin is not as profitable.

The target for Turn-Earn Index is 120.

In this case, inventory for an item with 1% margin needs to be turned 120 times in a year. An item with 10% profit margin needs to have only 12 inventory turns. An item with 60% margin need only have 2 inventory turns.

Once inventory turns targets have been calculated, it is easy to back calculate the days of inventory target.

One can easily calculate historical turn-earn index as well and segment products that are doing well versus ones where more work is needed.

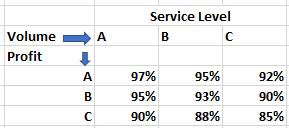

[You May Also Like: Five Customer Product Segmentation Pitfalls to Avoid ]This type of segmentation can also be used to establish service level targets. See example below.

All the examples stated above utilize profitability based segmentation to do analytics and set policies. There is an advanced use of profitability data as well. The data can be used to feed an optimization model such that all future decisions on what to make, where and when, becomes profit driven. This requires an optimization model to be built for the business. This an advanced topic that we will cover in a future blog post or whitepaper.

Enjoyed this post? Subscribe or follow Arkieva on Linkedin, Twitter, and Facebook for blog updates.