In my previous blog, I addressed how what-if analysis can help supply chains when faced with uncertainty. This blog is an attempt to delve into some specific what-if scenarios that could arise due to Brexit.

Impact of Brexit

The European Union was UK’s number one partner for trade in goods, comprising of about 55% of import and about 50% of exports in 2018, Brexit will have an impact on all this trade. The new deadline for Brexit is Jan 31st, 2020 which gives businesses a little more time to evaluate the impact of various scenarios on their supply chains post the deadline. Some major sources of uncertainty are:

- Lead times – lead times are set to increase owing to the new set of paperwork and processes that the traded goods will be put under at the ports once Brexit comes into effect. The officers at the ports, for example, will have a learning curve to go through given that the nature of activity at ports will be vastly different from the current process (which is basically a free movement of labor, goods, services, and capital). All of this necessitates prior planning and sufficient training none of which seems to be at the forefront of the current discourse given the mayhem about the deal itself. So, while an increase in lead times is certain, the extent is not. While the initial impact could smoothen out over the course of time it is better to be prepared for both short- and long-term impacts.

- Tariffs – There is also uncertainty on the extent of tariffs. A no-deal Brexit, which is still a possibility (an ever-increasing one considering the way things have panned out so far), could reset the terms to WTO norms which means a higher tariff in general.

- Availability of labor, capital, and other services will also be greatly affected.

Baseline Plan

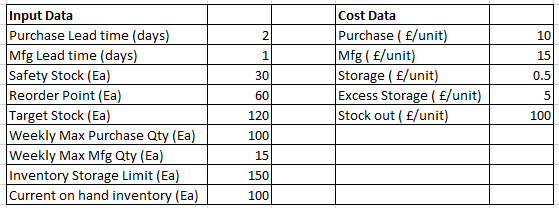

Let’s consider a company that has a manufacturing unit in the UK and imports some of the components needed from the EU. The product needs one unit of component ABC to make it (apart from other components that have not been considered for this analysis). The table below shows some information on the component ABC.

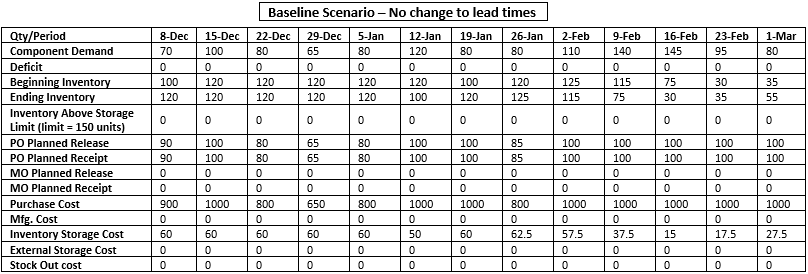

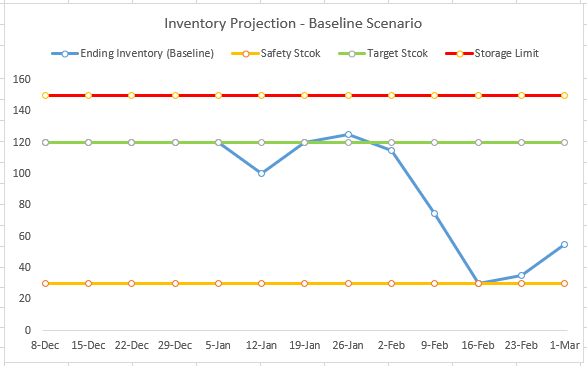

The master production schedule (MPS) is done in weekly buckets. The data given above is a constant for all the weeks in the planning horizon, but typical of a planning software, the planners should be easily able to adjust any of this for specific weeks. The table below is a depiction of recommendations from the planning system used by the company. This has been fixed to be the baseline scenario, following are some comments on the plan:

- The system recommends PO/MOs to meet the demand for the component and maintain the inventory between safety stock and target stock (as close as possible to the latter) and such that the order quantities are within the weekly PO/MO limits.

- The plan indicates no use for inhouse production and external storage with the current purchase lead time and supplier capacity.

- The main driver in arriving at the plan is the total cost as calculated based on the cost data provided with the objective of minimizing it. Note that the results used here may not be optimal in terms of the overall cost as they are intended to be just samples.

Read More: Supply Chain Planning in the Times of a Trade War

What-If lead time increases?

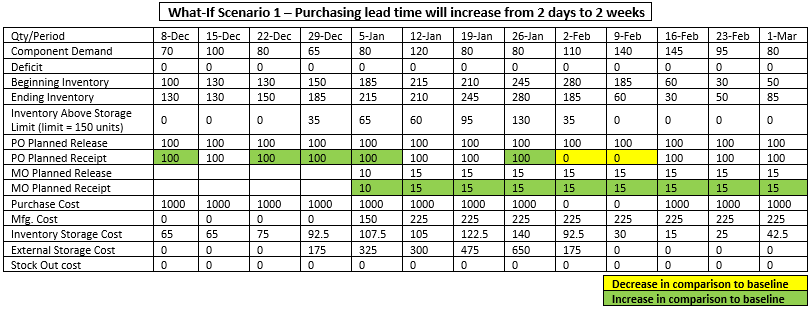

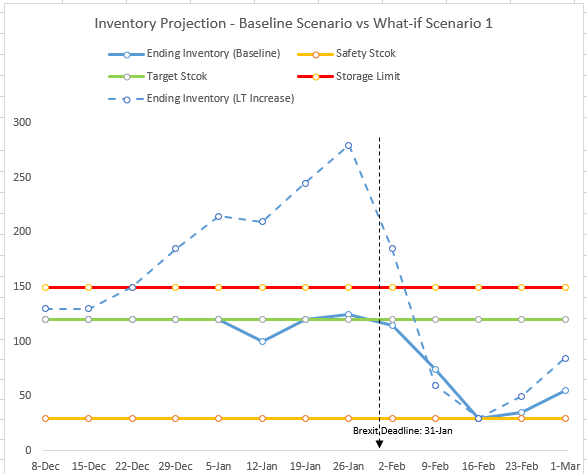

The company has estimated that the purchasing lead time for the component ABC will increase to 2 weeks after the deadline. To evaluate the impact, the planner will need to update the purchasing lead time for component ABC to 2 weeks beyond Jan-31 and run a what-if scenario. The table below shows new recommendations. All the changes when compared with the baseline scenario have been highlighted in yellow (decrease) and green (increase), there could be more ways to compare the results between scenarios depending on the capabilities of the software. Following are some inferences:

- PO recommendations, before the deadline, are much higher compared to the baseline scenario. This is to build up stock before the deadline to help make up for the lack of receipts in a couple of weeks immediately after the deadline.

- In house production has also been triggered from the week of 5-Jan to add more stock before the deadline.

- Inventory is projected to go above the limit (150 units) starting the week of 29-Dec which means that external storage will be needed leading to additional costs. It is important to consider a higher than normal cost for external storage given that a lot of businesses may be looking to build up stock.

- The overall cost is much higher than the baseline due to inhouse production and additional inventory storage.

Read More: How do you create a streamlined process for analyzing what-if scenarios?

There could be different estimates of lead times that may need to be evaluated. There could also be other conditions necessitating more what-if scenarios. While different products may need to be treated differently, it is best to evaluate the impact of various scenarios at a global level rather than for individual items, especially if the resources are shared. Decisions on how to cope up with Brexit will follow once the impact is clear.

In my next blog, I’ll cover a few more relevant scenarios.

Enjoyed this post? Subscribe or follow Arkieva on Linkedin, Twitter, and Facebook for blog updates.